- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Troubleshooting

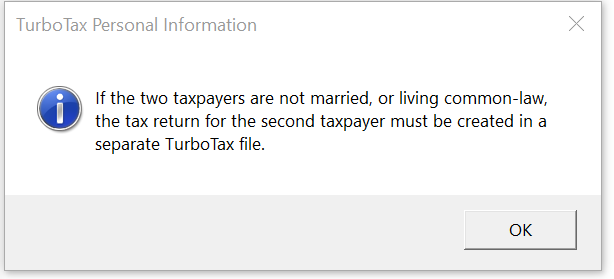

If the couple is separated, then they should not be preparing their returns together. The returns should be prepared separately, and with the correct marital status selected. Then you don't have to override the eligible dependant amount. You would just claim it on one return and not the other.

May 13, 2022

5:49 PM