Open TurboTax

Open TurboTax

Why sign in to the Community?

- Submit a question

- Check your notifications

- TurboTax Support

- :

- Discussions

- :

- Troubleshooting

- :

- Troubleshooting

- :

- Re: override line 30400

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Announcements

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

override line 30400

When I override line 30400 by bringing it to zero (amount for eligible dependent) Netfile does not let me send my tax return electronically. Is there any way of fixing this problem?

When couples are separated only one parent can claim the credit. The other parent must override the amount by entering zero.

Topics:

posted

April 17, 2022

7:14 AM

last updated

April 17, 2022

7:14 AM

1 Reply

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

override line 30400

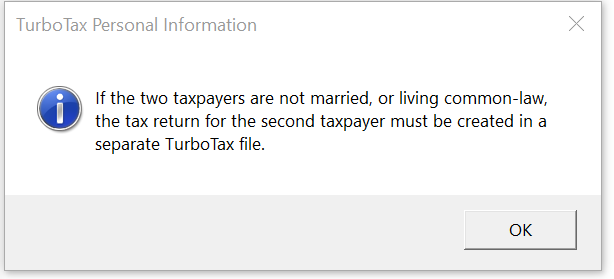

If the couple is separated, then they should not be preparing their returns together. The returns should be prepared separately, and with the correct marital status selected. Then you don't have to override the eligible dependant amount. You would just claim it on one return and not the other.

May 13, 2022

5:49 PM

Unlock tailored help options in your account.

Related Content

Wheeler-Shaw

Returning Member

GregJAnthony

Level 1

Arlene1947

New Member

CM1965

Level 3

DirkD

Level 1