- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

if cra slips are downloaded online, do i need to manually split 50% combined income for spouse

I have my own mutual fund and i have joint/combined mutual fund with my wife.

when I download T-slips from CRA website, I get all T-slips, my own and joint T-slips.

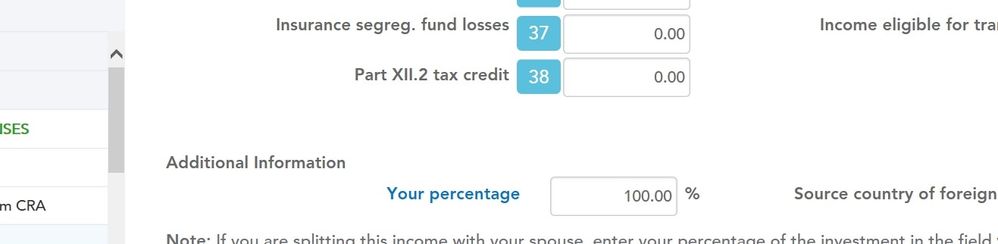

1. Do I need to go and manually show 50% in your percentage.

2. There are many slips automatically downloaded from CRA, how do I know which one is comined

and which on is individual.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Troubleshooting

Yes, if it's a joint account, then you'll need to go into the slip and enter the split.

To figure out which slip is which, you'll have to compare it with the copy of the slip that you got from the issuer.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Troubleshooting

Thanks. One more question. Do I show 50 percent also on my wifes T Slip in addition to mine.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Troubleshooting

Yes you will need to include 50% on your spouse's return if you received only one combined information slip for the two of you.

Thank you for choosing TurboTax.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Troubleshooting

Thanks Admin. Just want to be clear, If I get combined slip, I need to enter 50% on both, mine and my wife's account. is this correct.

K