- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Troubleshooting

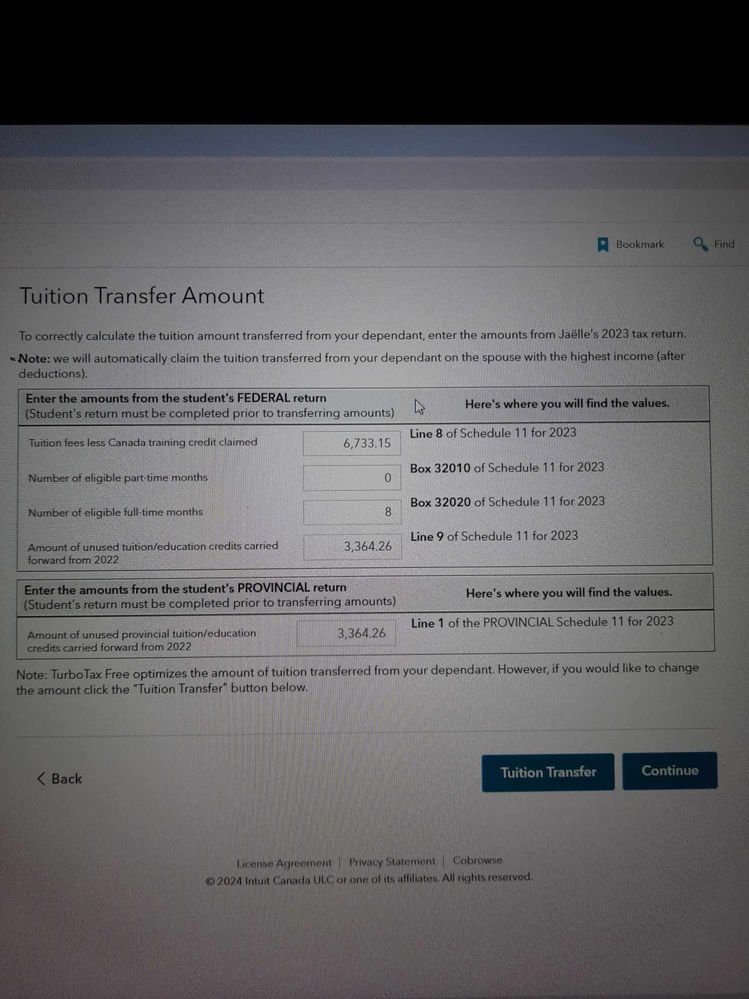

What I don't understand is why I only see the option of entering the amount of unused tuition carried forward from 2022 end tuition fees claimed. I transfered 5000$ from her 2023 tax return. She had 3364.26 of unused tuition fees in 2022. 7633.15 in 2023. I don't see any place to enter the 5000$ transfered.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Troubleshooting

Eligible tuition to be transferred can only be taken from this year-2023 and not prior years. Please see our TurboTax FAQs below to review the steps of tuition transfers.

How do I transfer my unused tuition credits to someone else?

How do I enter tuition transferred from my spouse/partner or child?

If you still need help with this situation, we believe your best option is to contact our telephone support team for further assistance, as they have the option to view your screen to help resolve the issue. To contact them, please follow this link: Contact Us. When asked if you wish to receive an email say NO then say "speak to a representative" then hold the line.

Thank you for choosing TurboTax.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Troubleshooting

That is what I am trying to explain. I am following the steps by clicking the transfer tuition amount under dependant's credits and I get the screen I shared above. I should see a screen with the option of entering the trasnfered amount for 2023 and it' not what I am getting. There must be a glitch in the online site.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Troubleshooting

@Blaisjoel In TurboTax Online, the program calculates the optimal amount of tuition that's transferred. However, if TurboTax is claiming the maximum amount, and you would like to claim less click the "Tuition Transfer" button.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Troubleshooting

TurboTax Support, Please confirm my findings.

I think for my case I have solved the $0.00 transfer of tuition to parent when there are amounts to transfer. I have 3 students to transfer tuition from and only one of them actually transfers the amount it should have. In trying to figure out the difference in the 3 students, I concluded this...... On the "Additional Dependants Information" Page in Turbo Tax under " Was _______ a student in 2023?" it asks for info from the students 2023 tax return. "Federal non-refundable credits (T1, sum of lines 30300 to 31400)" If you add values for these line items it actually does not include the Basic Personal Amount of $15000.00. In Schedule 11 it includes this amount to calculate the amount of tuition is used under the students tax return and what can be transferred to the parent. So I guess Turbo tax either means to include this $15000. amount in line 30300 to 31400 field or it fails to calculate it in the transfer tuition screen. In my case lines 30300 to 31400 added up to $2400. I had $203.82 the would not transfer. When I added the $15000. (Now $17400.) in the non refundable tax credits field I was able to transfer the $203.82. This also worked for my other student that I couldn't transfer tuition.

It all seems like a simple mistake on my part but Turbotax"s wording for this field is misleading and there may be others that have fallen into this trap.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Troubleshooting

@JSoldham to review, am I reading correctly that you have solved the issue you were having? Thank you for your update and we value your opinion.

Thank you for choosing TurboTax.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Troubleshooting

How is that possible? The online version offers no way of accessing forms. I can't even find T1 general let alone schedule 11. You must be using a different version?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Troubleshooting

I have been trying for two weeks to get my son's filing to show something other than $0 to transfer. When I go to his summary, it clearly shows that there is surplus from 2023 tuition. But the program absolutely refuses to show that amount. And since individual forms cannot be viewed, in the online deluxe version, you cannot see what is going on behind this. You are at the mercy of the software.

I have cleared the cache, went to my return and entered dependent information correctly. But the problem remains with the student's forms. It just will not place to surplus in the transferable box. Only wants to place it in the carry-over.