Open TurboTax

Open TurboTax

Why sign in to the Community?

- Submit a question

- Check your notifications

- TurboTax Support

- :

- Discussions

- :

- Navigating TurboTax

- :

- Getting started

- :

- The spot to enter subcontractors' costs can be located in...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I deduct costs to pay contractors for self-employment?

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I deduct costs to pay contractors for self-employment?

The spot to enter subcontractors' costs can be located in the Valuing Inventory section of the T2125. This screen is found directly after the Business Income section. Enter your subcontractor costs on the line marked "Subcontracts : Enter all the costs of hiring outside help to perform work related to the goods you sell."

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I deduct costs to pay contractors for self-employment?

The spot to enter subcontractors' costs can be located in the Valuing Inventory section of the T2125. This screen is found directly after the Business Income section. Enter your subcontractor costs on the line marked "Subcontracts : Enter all the costs of hiring outside help to perform work related to the goods you sell."

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I deduct costs to pay contractors for self-employment?

Can not find it, please clarify.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I deduct costs to pay contractors for self-employment?

@bassemomary Are you using TurboTax CD/Download or TurboTax Online?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I deduct costs to pay contractors for self-employment?

I also have the same question! I am using Turbo Tax Online.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I deduct costs to pay contractors for self-employment?

In TurboTax Online, you can enter subcontractor expenses in the Inventory section, just after Income.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I deduct costs to pay contractors for self-employment?

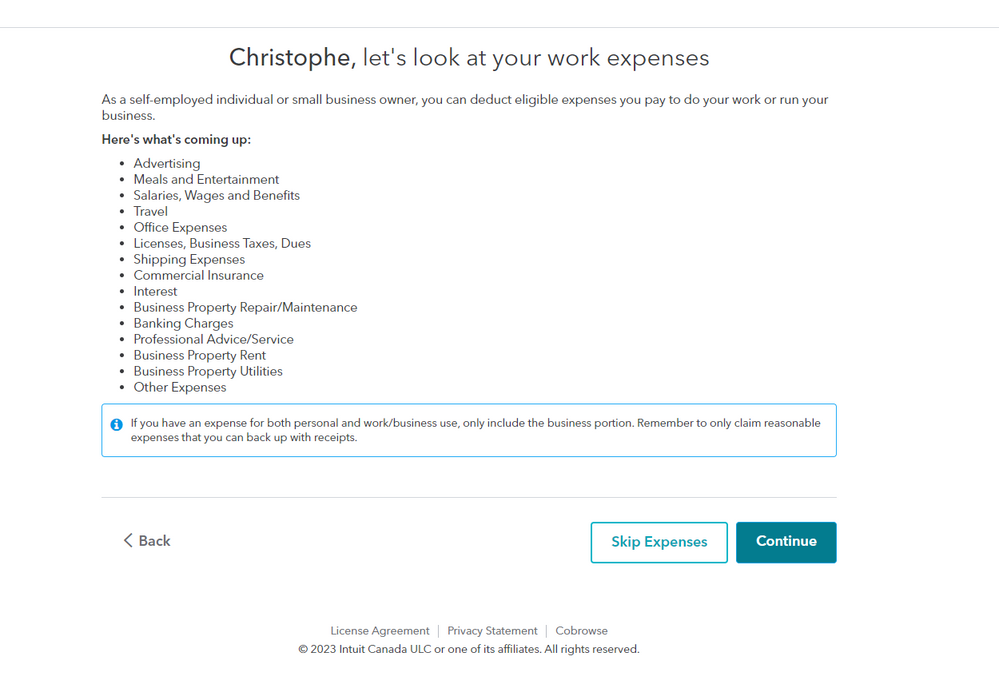

Sub contractor does not come up as an option for me under work expenses

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I deduct costs to pay contractors for self-employment?

@Canadork It's not under expenses. You can enter subcontractor expenses in the Inventory section, just after Income.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I deduct costs to pay contractors for self-employment?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I deduct costs to pay contractors for self-employment?

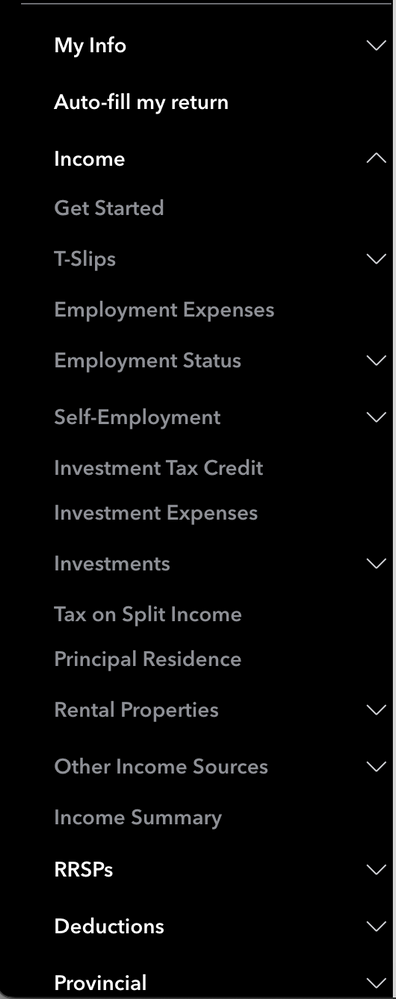

@CandianTaxpayer

You have to go to the Self-Employment section, then go into your business (or create one) to see the Inventory part of the Self-Employment section.

Related Content

eyesoelectric

Returning Member

smith-contractin

New Member

lynnkiara

New Member

emoller5612

New Member

user2506321386

New Member