Open TurboTax

Open TurboTax

Why sign in to the Community?

- Submit a question

- Check your notifications

- TurboTax Support

- :

- Discussions

- :

- Navigating TurboTax

- :

- Investments & rentals

- :

- How to report income from rented out foreign property that was inherited?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report income from rented out foreign property that was inherited?

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report income from rented out foreign property that was inherited?

You will need to report three things:

1. Rental Income

2. Foreign Tax Paid on Rental Income, and

3. Foreign Property Information Reporting on the T1135

Foreign Rental Income

First, complete the T776 Statement of Real Estate Rentals.

1. Using the navigate menu up top, select Income > Rental Property

2. Enter all relevant fields in the T776

NOTE: CRA will not allow you to file your return using NETFILE if the rental address doesn’t have a Canadian province and postal code entered.

As a workaround, we suggest that you enter the foreign address on the “Address” lines, and the foreign city and country in the “City” field. Finally, input your residential province and postal code in the corresponding province and postal code fields.

Foreign Tax Credit

1. Select Find in the top right hand corner

2. Type "foreign" and select Foreign Tax Credit

3. Select Yes to the Foreign Taxes page.

4. Enter the country your foreign property is located

5. In the section “Foreign real property income:”, enter the gross rental income amount, related expenses and the amount of foreign taxes you paid.

NOTE: The amount of income entered on the Foreign Tax Credit form will not add additional income to your return. It is needed, however, to properly calculate the foreign tax credit for the country you specified.

T1135

1. Using the navigate menu up top, select Income > Other Income Sources > T1135

2. Follow the prompts on the screen.

NOTE: The T1135 is information reporting only. We recommend choosing the simplified method if your assets are over $100K but under $250K.

Again, you will need to enter the income corresponding to each of your foreign property. Income entered on the T1135 will not affect your income tax return.

Lastly, the T1135 needs to be filed separately from your income tax return. When you are ready to file, you will see an additional button to file your T1135 using CRA’s NETFILE service.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report income from rented out foreign property that was inherited?

This thread has many questions and I will try to provide an answer to all.

If you are renting personal property (you stay in this property when visiting) to cover the expenses, then you don't have to report it as a foreign rental income. If you are renting a personal property to make revenue (income) and the cost value of the property was $100K CAD or more, then you have to report the income.

To report the foreign rental income, there are two methods used in TurboTax:

1. Report the net amount on the Foreign Income Slip or

2. Report the gross/loss on the Rental T776 form.

Reporting the net amount on a Foreign Income Slip: Do Not Use T776

-

Foreign Property Verification Information Reporting on the T1135

-

If the net rental income is above zero > use the other income box and the tax deducted box

However, If the net rental income is below zero (loss in revenue) you will not be able to you the foreign slip> use other deduction profile and use the Foreign Tax Slip form.

Reporting the gross/loss using T776:

You will need to report three things:

1. Rental Income on a T776 form whether it is in a gross or loss amounts

Use your Canadian address in the form > change the city to the foreign country's city

2. Foreign Tax Paid on Rental Income on a Foreign Tax Credit form, and

3. Foreign Property Verification Information Reporting on the T1135

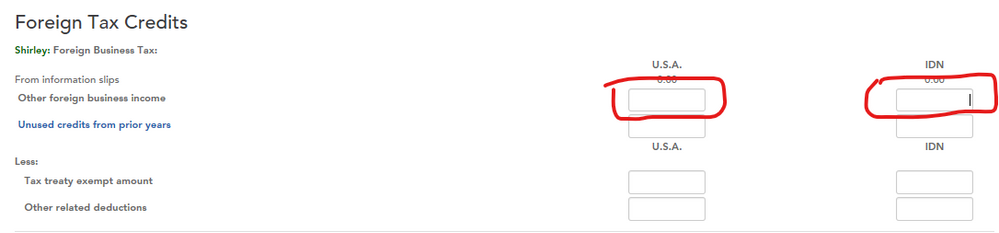

If you are using the Foreign Tax Credit Profile with any of these reporting options:

- If you are using TurboTax Online: Report the income and tax paid under the "Foreign Real Property"

- If you are using TurboTax Desktop: Report the income and tax paid under the "Foreign Business Income"

- Any income reported under this profile will not double your rental income.

If you have foreign Investment to report> you either report it under the foreign income slip, or you report the slip you receive from you Canadian broker

I hope this was helpful

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report income from rented out foreign property that was inherited?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report income from rented out foreign property that was inherited?

You will need to report three things:

1. Rental Income

2. Foreign Tax Paid on Rental Income, and

3. Foreign Property Information Reporting on the T1135

Foreign Rental Income

First, complete the T776 Statement of Real Estate Rentals.

1. Using the navigate menu up top, select Income > Rental Property

2. Enter all relevant fields in the T776

NOTE: CRA will not allow you to file your return using NETFILE if the rental address doesn’t have a Canadian province and postal code entered.

As a workaround, we suggest that you enter the foreign address on the “Address” lines, and the foreign city and country in the “City” field. Finally, input your residential province and postal code in the corresponding province and postal code fields.

Foreign Tax Credit

1. Select Find in the top right hand corner

2. Type "foreign" and select Foreign Tax Credit

3. Select Yes to the Foreign Taxes page.

4. Enter the country your foreign property is located

5. In the section “Foreign real property income:”, enter the gross rental income amount, related expenses and the amount of foreign taxes you paid.

NOTE: The amount of income entered on the Foreign Tax Credit form will not add additional income to your return. It is needed, however, to properly calculate the foreign tax credit for the country you specified.

T1135

1. Using the navigate menu up top, select Income > Other Income Sources > T1135

2. Follow the prompts on the screen.

NOTE: The T1135 is information reporting only. We recommend choosing the simplified method if your assets are over $100K but under $250K.

Again, you will need to enter the income corresponding to each of your foreign property. Income entered on the T1135 will not affect your income tax return.

Lastly, the T1135 needs to be filed separately from your income tax return. When you are ready to file, you will see an additional button to file your T1135 using CRA’s NETFILE service.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report income from rented out foreign property that was inherited?

For annual rental payment paid in advance (full year) and the period is straddle between two years. I assume I will report the rental income using accrual method, meaning I will report income and expense just for the year I am filling out my taxes. Am I correct?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report income from rented out foreign property that was inherited?

Yes, you would report only the amounts of rental income which you actually received for the tax year in which you are filing.

For example: The rent was paid for the period Jun 1st to May 31 the following year. You would only claim the income for seven months - Jun to Dec.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report income from rented out foreign property that was inherited?

You said "Enter all relevant fields in the T776", and "In the section Foreign real property income: enter the gross rental income amount, related expenses and the amount of foreign taxes you paid."

Does this mean that we should enter rental related expenses (such as foreign tax paid, utilities, etc) on both form T776 and the foreign tax credit page?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report income from rented out foreign property that was inherited?

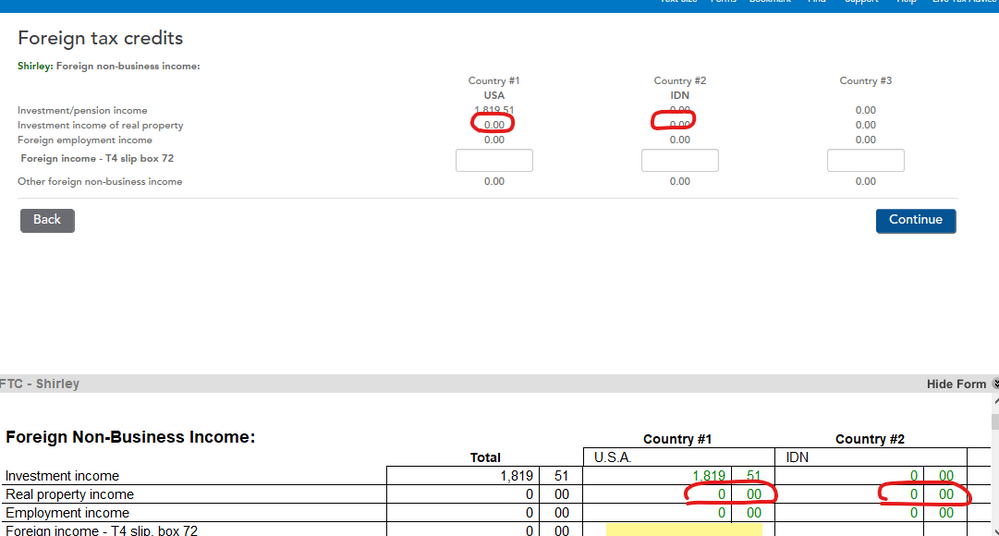

@TurboTaxMonica1 I followed your direction, but got stuck when entering FTC paid. As you can see on below screenshot, the cell for real property income is grayed out.

Secondly, are below the place to put the FTC amount?

Thanks.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report income from rented out foreign property that was inherited?

@TurboTaxMonica, @TurboTaxKim I have also run into same problem. Text box to enter real estate income is not enabled.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report income from rented out foreign property that was inherited?

I also tried the forms method i.e. update FTC through forms. Double clicking box in FTC form takes me to Foreign slip form and I cannot enter rent here because I have already added details in T776.

EDIT: I was able to get the form to enter FTC, but like mentioned in previous post on this thread the box to enter real estate income is not enabled.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report income from rented out foreign property that was inherited?

@Vikas1

To enable the rental income in the T776.

- You must first select the checkboxes that apply to your situation. in the rental profile window in the EasyStep (rental income, rental expenses).

- then, move forward to complete the process.

Yes, you will need to report three things:

1. Rental Income and expenses on T776

2. Foreign Tax Paid on Rental Income on FTC

3. Foreign Property Information Reporting on the T1135

Related Content

vinny8

New Member

nicholasaidan

New Member

Greg105

Returning Member

dadaniabc

New Member

joeftabah

New Member