Open TurboTax

Open TurboTax

Why sign in to the Community?

- Submit a question

- Check your notifications

- TurboTax Support

- :

- Discussions

- :

- Navigating TurboTax

- :

- Investments & rentals

- :

- Re: I just discovered that the capital gains (4 x T5008 slips) were double-counted - first on For...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

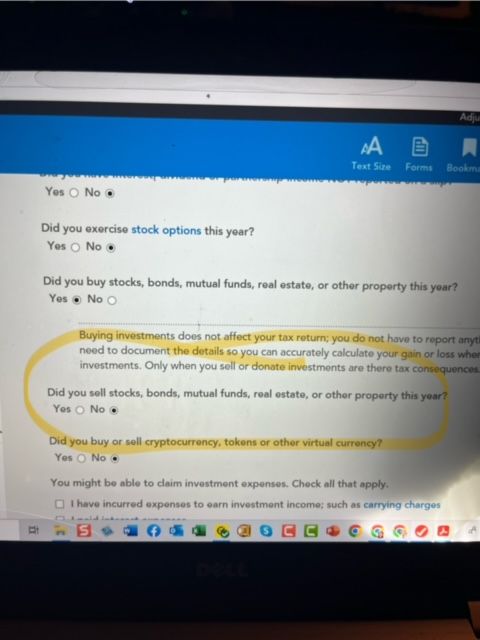

I just discovered that the capital gains (4 x T5008 slips) were double-counted - first on Form 3 and then again on Form 3 Supp. Did anyone else have this issue for 2022?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I just discovered that the capital gains (4 x T5008 slips) were double-counted - first on Form 3 and then again on Form 3 Supp. Did anyone else have this issue for 2022?

The bottom section of the S3 Supp is for your information only. It shows you what is being transferred to Schedule 3 from the T5008 T-Slips and Receipts entry screen.

Your capital gains would only be double counted if you entered the same amounts in the top portion of the S3 Supp as well as on your T5008 slips.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I just discovered that the capital gains (4 x T5008 slips) were double-counted - first on Form 3 and then again on Form 3 Supp. Did anyone else have this issue for 2022?

Thanks for your quick response Susan!

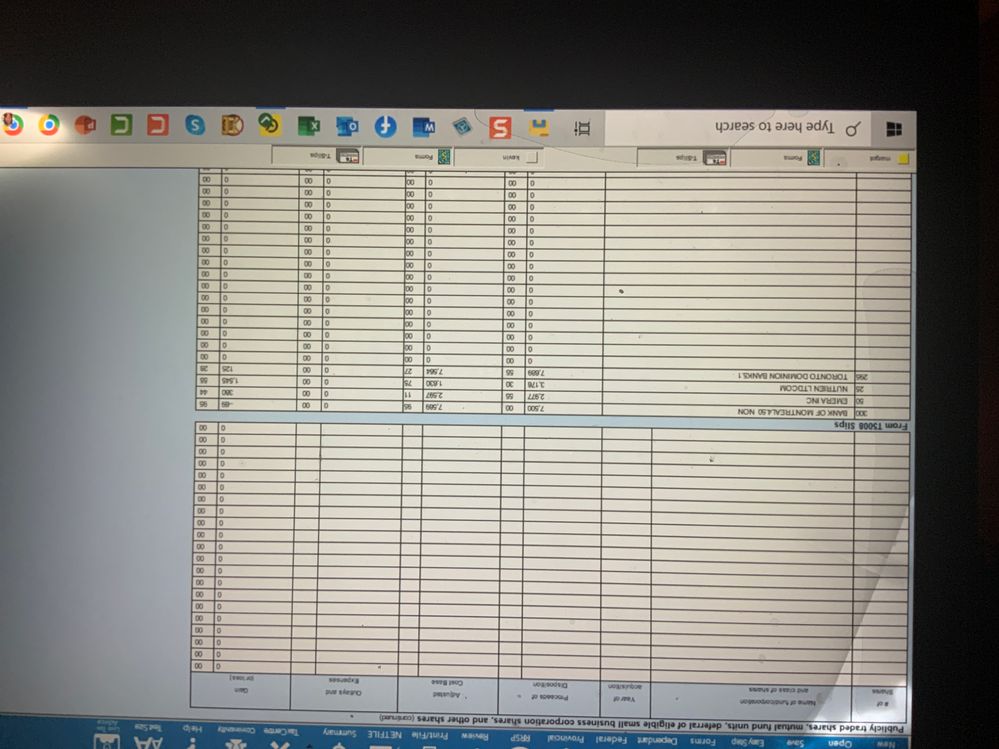

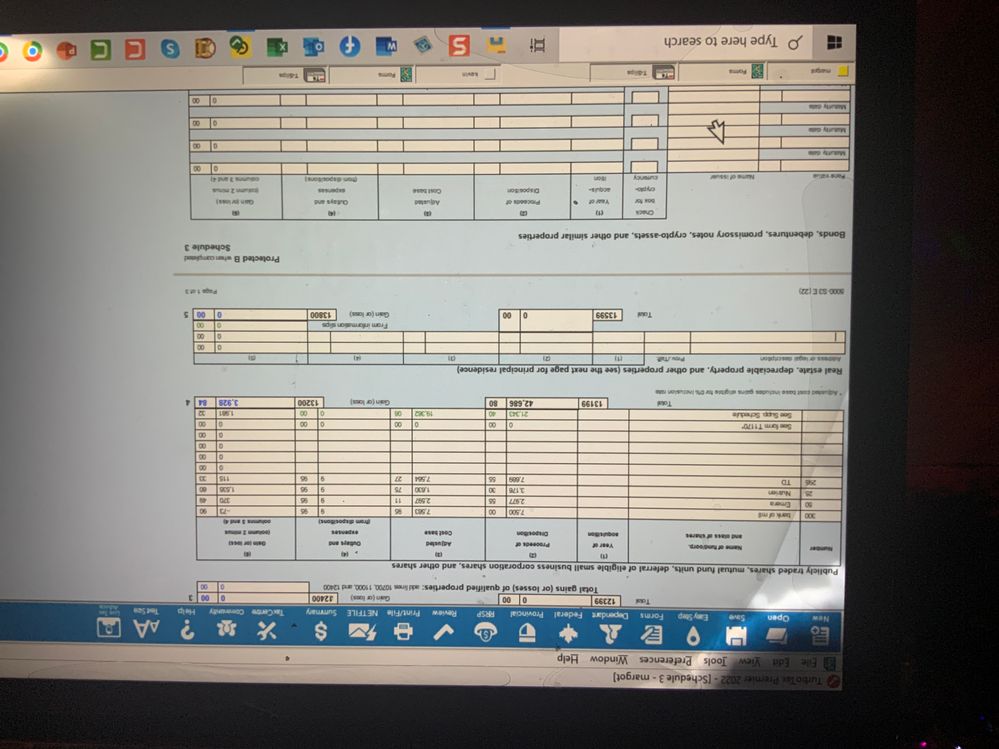

here is what I see in S3 supplemental “from T5008 slips “ and Schedule 3 “see Support schedule. I don’t recall entering them twice but it is certainly possible! How do I remove them from Supp? I can’t seem to do it manually.

thanks.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I just discovered that the capital gains (4 x T5008 slips) were double-counted - first on Form 3 and then again on Form 3 Supp. Did anyone else have this issue for 2022?

As I mentioned before, the bottom section of the S3 Supp comes from your T5008 T-Slips. It can't be erased without removing the T5008 slips.

The top part of the section on Schedule 3 titled "Publicly traded shares, etc..." is filled in either by typing directly into the form or through the Capital gains pages in EasyStep mode. If you enter the same information that was on your T5008 here, then your capital gains will be double. You can just delete the information if there is duplication.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I just discovered that the capital gains (4 x T5008 slips) were double-counted - first on Form 3 and then again on Form 3 Supp. Did anyone else have this issue for 2022?

Got it!

Might I suggest the following change in "easy step" instructions . . .

Add "Do not enter if not already included in slips".

Thanks for the clarifications!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I just discovered that the capital gains (4 x T5008 slips) were double-counted - first on Form 3 and then again on Form 3 Supp. Did anyone else have this issue for 2022?

I have passed on your suggestion to our product development team. Thank you for your input.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I just discovered that the capital gains (4 x T5008 slips) were double-counted - first on Form 3 and then again on Form 3 Supp. Did anyone else have this issue for 2022?

In addition to alerting users not to enter the same information that's already on the T5008 again, it would be REALLY helpful if a note could be added somewhere in TurboTax that if your Adjusted Cost Base (ACB) is different from what's in Box 20: Cost or book value, then users should overwrite this amount with their own calculated ACB. I spent almost 3 days trying to figure this out. In many ways TurboTax can be improved to make it not so confusing to users.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I just discovered that the capital gains (4 x T5008 slips) were double-counted - first on Form 3 and then again on Form 3 Supp. Did anyone else have this issue for 2022?

Unlock tailored help options in your account.

Related Content

ninafaria402

Level 2

tristanjinx

New Member

rania2025

New Member

jordan_tibbo

New Member

vinceboydjohns

New Member