Open TurboTax

Open TurboTax

Why sign in to the Community?

- Submit a question

- Check your notifications

- TurboTax Support

- :

- Discussions

- :

- Navigating TurboTax

- :

- Investments & rentals

- :

- Re: T3 FORM. Do amounts from Boxes 25,42 & 34 get reported? If so it comes up as foreign income & asks me from which country?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

T3 FORM. Do amounts from Boxes 25,42 & 34 get reported? If so it comes up as foreign income & asks me from which country?

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

T3 FORM. Do amounts from Boxes 25,42 & 34 get reported? If so it comes up as foreign income & asks me from which country?

Box 25 is Foreign income and Box 34 Foreign Income Tax paid on Investment, so it is supposed to come out as foreign income. You can enter the source country of foreign income in the space provided at the bottom right of the page. Enter the country where the income was generated or earned. If the income is from a global fund (possibly from more than one country) or if you don't know which country the income is from, enter Global.

Box 42 is Amount resulting in cost base adjustment. It tells you if something has been added to the adjusted cost base (ACB) of the property, or subtracted from the ACB.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

T3 FORM. Do amounts from Boxes 25,42 & 34 get reported? If so it comes up as foreign income & asks me from which country?

Box 25 is Foreign income and Box 34 Foreign Income Tax paid on Investment, so it is supposed to come out as foreign income. You can enter the source country of foreign income in the space provided at the bottom right of the page. Enter the country where the income was generated or earned. If the income is from a global fund (possibly from more than one country) or if you don't know which country the income is from, enter Global.

Box 42 is Amount resulting in cost base adjustment. It tells you if something has been added to the adjusted cost base (ACB) of the property, or subtracted from the ACB.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

T3 FORM. Do amounts from Boxes 25,42 & 34 get reported? If so it comes up as foreign income & asks me from which country?

what does country #2 and country #3 mean on the T3. It states in one of the posts to select "Global" but that is not an option.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

T3 FORM. Do amounts from Boxes 25,42 & 34 get reported? If so it comes up as foreign income & asks me from which country?

If you have more than one country where you have generated income #2 or #3

Where it asks to enter the country code-

Enter the country where the income was generated or earned. If the income is from a global fund (possibly from more than one country) or if you don't know which country the income is from, enter Global. (You will type it in)

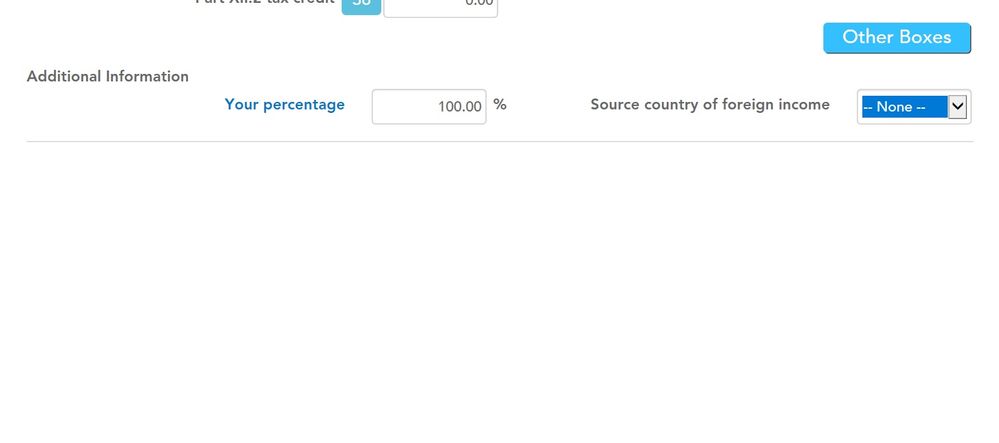

See screenshot below- This is what it was talking about.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

T3 FORM. Do amounts from Boxes 25,42 & 34 get reported? If so it comes up as foreign income & asks me from which country?

Thanks for the response but I don't have this box. I am filing a Canadian tax return as well I have the Standard version. This is what I have and when you click on the pull down the selection is US, Country #2, Country #3.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

T3 FORM. Do amounts from Boxes 25,42 & 34 get reported? If so it comes up as foreign income & asks me from which country?

If you have foreign income from another country other than the USA then you will enter the other country in #2 and next in #3 boxes.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

T3 FORM. Do amounts from Boxes 25,42 & 34 get reported? If so it comes up as foreign income & asks me from which country?

You can change Country #2 and Country #3 if you are using TurboTax Desktop:

Go to Form, Select FTC (Foreign Tax Credits Worksheet)

Type your names (i.e. Global) under Country #2 and Country #3 in the second row

These names will now be available in the pulldown menus within EasyStep and if you previously chose Country #2 or #3 from those pulldowns, they will have been modified with the names you typed.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

T3 FORM. Do amounts from Boxes 25,42 & 34 get reported? If so it comes up as foreign income & asks me from which country?

Good morning

I have TSFA's for all 4 Grandchildren. Source Country box 34. I've tried to change to Country 2 & Country 3 but no drop down box??? I put in USA because I have no idea????

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

T3 FORM. Do amounts from Boxes 25,42 & 34 get reported? If so it comes up as foreign income & asks me from which country?

@Cherhamm I'm not sure what you are trying to do? Normally you never need to report anything to do with a TFSA - that is because it is Tax Free! You may safely ignore your TFSA slip info as CRA receives info from your banks on your deposits and your withdrawls - everything else is to be ignored.

https://www.canada.ca/en/revenue-agency/services/tax/businesses/topics/tax-free-savings-account-tfsa...

It might be possible, but unlikely, that your situation is more complicated. Can't tell without more precise info from you. If you do have some specifcally-TFSA slip that reports foreign income tax paid, you cannot claim that back like you can for a T3 from a regular non-registered account.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

T3 FORM. Do amounts from Boxes 25,42 & 34 get reported? If so it comes up as foreign income & asks me from which country?

Thank you so much for all the replies I got!! I have to clarify my situation.

I have T3's for my Grandchildren that I have in Trust for them.

I'm sorry I'm so stupid but I still don't understand 😔😔.

Box 34 I had to enter Foreign non-business tax paid. But Source of country of foreign income.

Drop down box gives me 3 options

USA, COUNTRY #2, COUNTRY #3. I've tried all 3 & I don't get an option to type Global like someone said.

I'm so sorry & appreciate an help ❤️

Related Content

MidNiteForms

New Member

thibautdrevet

New Member

na021

New Member

neha_mehra

New Member

wishness2

New Member