Open TurboTax

Open TurboTax

Why sign in to the Community?

- Submit a question

- Check your notifications

- TurboTax Support

- :

- Discussions

- :

- Navigating TurboTax

- :

- Investments & rentals

- :

- Turb Tax Premier does not let me proceed with Rental Income. Wants me to upgrade to Self-employed. But Premier does allow rental income as advertised.

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turb Tax Premier does not let me proceed with Rental Income. Wants me to upgrade to Self-employed. But Premier does allow rental income as advertised.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turb Tax Premier does not let me proceed with Rental Income. Wants me to upgrade to Self-employed. But Premier does allow rental income as advertised.

Have you entered an amount from any of the boxes on the slips listed here?:

- T4 slip: box 81, 82 or 83

- T4A slip: box 20 or 48

- T4A slip: box 28 and you answered Yes to the question Does the income declared in Box 028 consist of fees collected for services you provided? in TurboTax Online

- T3 slip: box 24 (foreign business income)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turb Tax Premier does not let me proceed with Rental Income. Wants me to upgrade to Self-employed. But Premier does allow rental income as advertised.

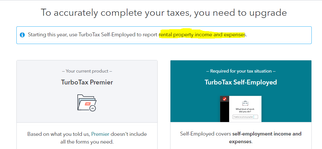

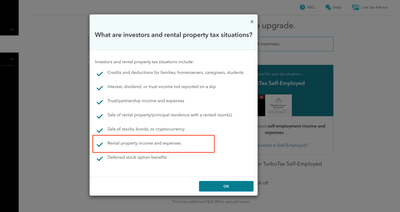

Please see below: Rental property income and expenses should be included with premier as advertised.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turb Tax Premier does not let me proceed with Rental Income. Wants me to upgrade to Self-employed. But Premier does allow rental income as advertised.

When you start a new return, TurboTax will ask you questions about your tax situation and recommend the best product for you. As you work on your taxes, you may have to change products based on the complexity of your return. You may be upgraded to help claim expenses you’re entitled to, but might not know about.

Any of the entries TurboTax Susan mentioned above will direct you to an upgrade to our Self-Employed version.

Thank you for choosing TurboTax.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turb Tax Premier does not let me proceed with Rental Income. Wants me to upgrade to Self-employed. But Premier does allow rental income as advertised.

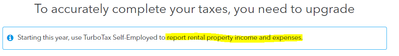

The screenshot that I included on the prevoious reply says "Rental property income" is the reason being why I am asked to upgrade. Pleaser review the screenshot again. I do not have all the boxes that Susan has indicated in her reply. Please check if there is a software issue....

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turb Tax Premier does not let me proceed with Rental Income. Wants me to upgrade to Self-employed. But Premier does allow rental income as advertised.

Unfortunately, you will need to upgrade to the self-employed software, as this is a change that was made this tax year.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turb Tax Premier does not let me proceed with Rental Income. Wants me to upgrade to Self-employed. But Premier does allow rental income as advertised.

I'm facing the same issue as the original poster. This is what displays when I click the "Premier" link on the page mentioned above. Premier should include "Rental property income and expenses". This is the product I've purchased in previous years to complete my return including rental income and expenses.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turb Tax Premier does not let me proceed with Rental Income. Wants me to upgrade to Self-employed. But Premier does allow rental income as advertised.

Please keep in mind the following information:

You need to determine whether the income you receive from renting out your property is considered a business or rental income. It depends on the number and types of services you provide to your tenants.

If you only provide basic services, such as heat, light, parking, and laundry facilities, then you are earning rental income from your property.

However, if you offer additional services like cleaning, security, and meals, you may be considered as carrying on a business. The more services you provide, the higher the likelihood that your rental operation is a business.

If you are operating a business from your rental income, you will need to upgrade to Self-Employed and complete the T2125. You should enter your name as the business name and your home address as the business address.

It's worth noting that if you receive T4 slip: box 81, 82 or 83, T4A slip: box 20 or 48, T4A slip: box 28 and answered "Yes" to the question "Does the income declared in Box 028 consist of fees collected for services you provided?" in TurboTax Online, or T3 slip: box 24 (foreign business income), the Canada Revenue Agency (CRA) will consider you self-employed.

When you are completing your return, does TurboTax prompt you to upgrade to Self-Employed, or is it giving you a choice?

Thank you for choosing TurboTax.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turb Tax Premier does not let me proceed with Rental Income. Wants me to upgrade to Self-employed. But Premier does allow rental income as advertised.

I am collecting rental income but I am not operating a business. How can I change the answer to the question "Does the income declared in Box 028 consist of fees collected for services you provided?"

It's prompting me to upgrade to Self-Employed (no choice) when I check the boxes for "Rental Income" and "Rental Expenses".

Thanks

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turb Tax Premier does not let me proceed with Rental Income. Wants me to upgrade to Self-employed. But Premier does allow rental income as advertised.

The question "Does the income declared in Box 028 consist of fees collected for services you provided?" would be on a T4a slip, if you entered one.

But for tax year 2023, if you have rental income, you'll need to use the Self-Employed version of TurboTax Online.

Related Content

telldinu

Level 2

Ihatepayingtaxes

New Member

jbs1

New Member

dan-zaf

New Member