Open TurboTax

Open TurboTax

Why sign in to the Community?

- Submit a question

- Check your notifications

- TurboTax Support

- :

- Discussions

- :

- Navigating TurboTax

- :

- Québec taxes

- :

- Military member working on Ontario and living in Quebec. Received a T4 and a Releve 1 but the values do not match.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Military member working on Ontario and living in Quebec. Received a T4 and a Releve 1 but the values do not match.

R1 only has values in Box J and Box L which add up to the total in Box A. Do I add Box A to the amount in Box 14 from the T4 in Turbotax? Or just include Box J and Box L and leave Box A as transferred from the T4?

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Military member working on Ontario and living in Quebec. Received a T4 and a Releve 1 but the values do not match.

Hello @Moondog79

Two things:

1. When entering the T4, make sure to enter "Ontario" as your province of employment. That way, you won't have to re-enter that amount on your RL-1. You seem to already have done that properly as you said you entered an RL-1 box A with only the "medical insurance" (aka Box J) and you did not question the amount on your Quebec return's line 101.

2. The way you described your problem, I understand you have a large balance due on your Quebec return but also a large refund on your T1 return. Remember... you indicated your province of employment was Ontario so the Quebec government did not receive any tax withheld at source. That explains the current status of your return, but there is a way to prevent that from happening.

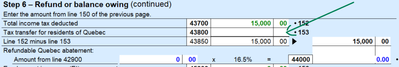

What's missing is the "Tax transfer for the residents of Quebec" - see line 43800. You are allowed to transfer up to 45% of the total income tax deducted (as shown on line 43700). You need to simply enter the necessary amount you want to transfer to your Quebec return, it's your decision, as long as it doesn't exceed that 45% limit.

Have a nice day!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Military member working on Ontario and living in Quebec. Received a T4 and a Releve 1 but the values do not match.

It's common for certain amounts on your T4 and RL-1 slips to be different, due to federal and Québec income taxes being calculated differently. You just need to enter them as they are.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Military member working on Ontario and living in Quebec. Received a T4 and a Releve 1 but the values do not match.

RL-1 only has the amount that is my medical insurance (taxable benefit in Quebec) and doesn't include the salary that is on the T4. If I change the input on TurboTax to just what's in the RL-1, my return ends up being over $20k which doesn't seem right??

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Military member working on Ontario and living in Quebec. Received a T4 and a Releve 1 but the values do not match.

Please contact our phone support team at 1-888-829-8608 as they will be better able to assist you. They can look at the return with you to see what is going on.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Military member working on Ontario and living in Quebec. Received a T4 and a Releve 1 but the values do not match.

Hello @Moondog79

Two things:

1. When entering the T4, make sure to enter "Ontario" as your province of employment. That way, you won't have to re-enter that amount on your RL-1. You seem to already have done that properly as you said you entered an RL-1 box A with only the "medical insurance" (aka Box J) and you did not question the amount on your Quebec return's line 101.

2. The way you described your problem, I understand you have a large balance due on your Quebec return but also a large refund on your T1 return. Remember... you indicated your province of employment was Ontario so the Quebec government did not receive any tax withheld at source. That explains the current status of your return, but there is a way to prevent that from happening.

What's missing is the "Tax transfer for the residents of Quebec" - see line 43800. You are allowed to transfer up to 45% of the total income tax deducted (as shown on line 43700). You need to simply enter the necessary amount you want to transfer to your Quebec return, it's your decision, as long as it doesn't exceed that 45% limit.

Have a nice day!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Military member working on Ontario and living in Quebec. Received a T4 and a Releve 1 but the values do not match.

To be sure, are you saying leave the pre-filled R1 as is (ie amount in Box A same as Box 14 in T4) AND enter a new R1 with Box A including ONLY the amounts in Boxes J and L?

Thank you

Unlock tailored help options in your account.

Related Content

cigarman16@gmail

New Member

birdiepars

New Member

marie-aprieto

New Member

Moondog79

Returning Member