Open TurboTax

Open TurboTax

Why sign in to the Community?

- Submit a question

- Check your notifications

- TurboTax Support

- :

- Discussions

- :

- Troubleshooting

- :

- Troubleshooting

- :

- Childcare receipt without releve 24 showed an error

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Childcare receipt without releve 24 showed an error

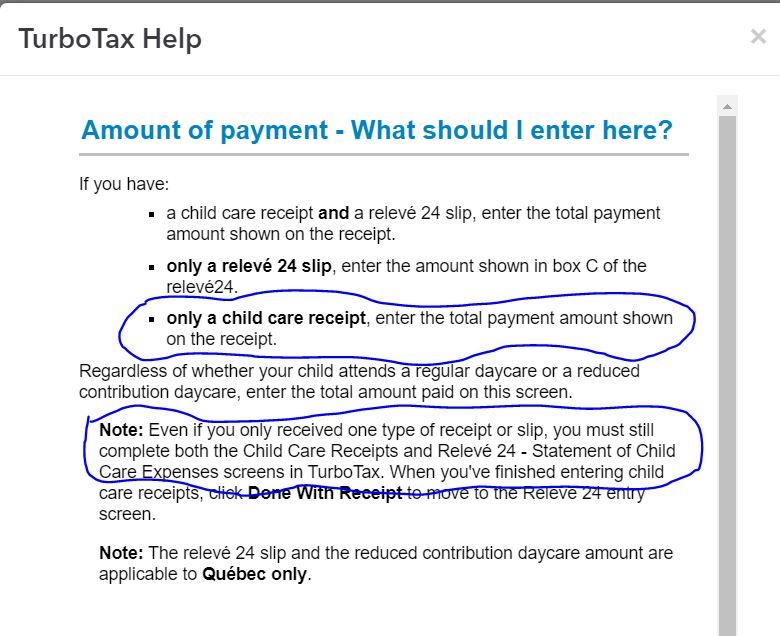

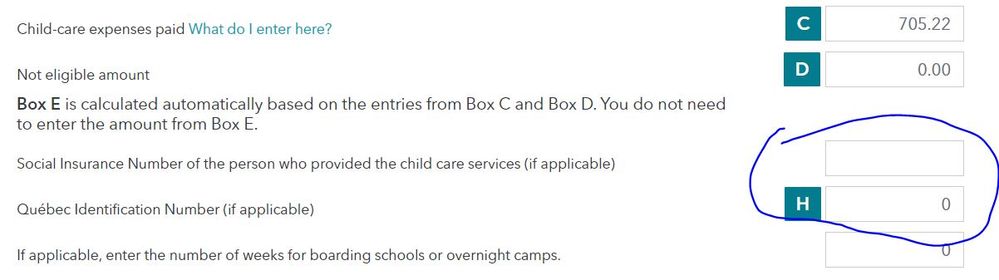

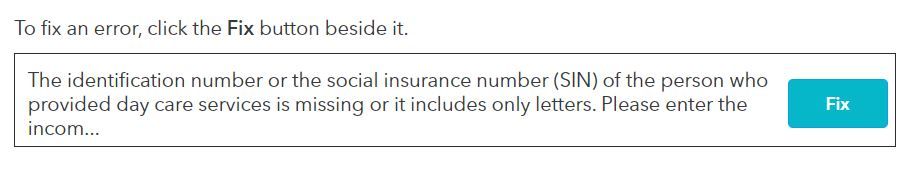

I am Quebec resident, I have a childcare receipt for federal 21400. I followed the guide of Turbotax to enter it in both receipt summary and Quebec releve 24 (without service provider id). While system validation, it showed the error that it missed the service provider identification number or social security id. With this error, I cannot file Quebec tax online. I have already filed the federal tax, what shall I do next? Thanks.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Childcare receipt without releve 24 showed an error

In order to NetFile your QC when claiming Childcare Expenses, on the Releve 24 you need to enter the SIN of an Individual or the Québec Identification Number of an organization. This is a mandatory entry and cannot be bypassed.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Childcare receipt without releve 24 showed an error

Actually, I called Revenu Quebec to discuss this matter. The employee said that the Identification number or SIN is not an information required by RQ, and that this actually looks like a requirement of the software. He even told that the software is the problem.

When will TurboTax solve this? This problem is reported year after year. I tried adding 0s as suggested from other comment threads but it still will not work and I get the error message telling me I cannot submit online. What is the point of buying this software if I cannot even file my taxes online properly?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Childcare receipt without releve 24 showed an error

Thank you for your feedback, we value your opinion and have shared this information with the proper TurboTax team.

Thank you for choosing TurboTax.

Related Content

JRMCV

Returning Member

bscott2799-gmail

Returning Member

ceocoronado

Returning Member

herbertxjchen

Level 1

tracie_arsenault

New Member