Open TurboTax

Open TurboTax

Why sign in to the Community?

- Submit a question

- Check your notifications

- TurboTax Support

- :

- Discussions

- :

- Troubleshooting

- :

- Troubleshooting

- :

- Difficulties reporting net capital loss from previous years to claim against 2023 capital gains.

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Difficulties reporting net capital loss from previous years to claim against 2023 capital gains.

Hello,

On my 20022 notice of assessment I have about $5683 of capital losses which can be used. However, TurboTax shows I have 0 to apply in Line 25300.

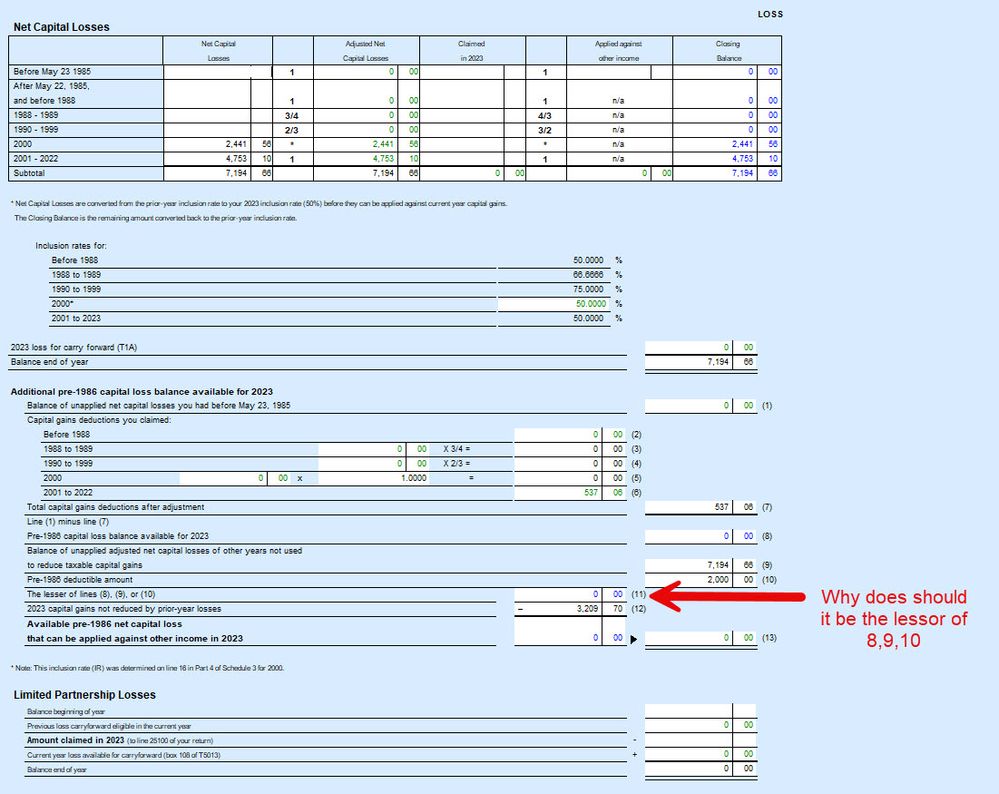

I attach the LOSS form for your reference.

In summary:

- In line 25300 has 0, when I click it takes me to the LOSS form

- The form in the Net Capital Losses shows I have a closing balance of 7195.66 (9) "Balance of unapplied adjusted net captial losses of other years not used to reduce taxable gains".

- Pre-1986 capital loss balance available for 2023 is 0 (8).

- Pre-1986 deductible is 2000 (10).

- The lessor of 8 [0], 9 [7195.66], 10 [0] goes into (11) which is 0

The next line results in a negative amount that can be applied 0 - $3207 = 0

I have 0 to apply, but revenue canada says I have $5683 available as capital losses.

I don't understand why (8), (10) matters. How can I correct 8 & 10 as it will block me from using the capital losses.

Do I need to override the 25300 and enter an amout equal to the capital gains I am offsetting and file manually? Please advise.

Thanks

Pat

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Difficulties reporting net capital loss from previous years to claim against 2023 capital gains.

In order to help you with this situation, we believe your best option is to contact our telephone support team for further assistance, as they have the option to view your screen to help resolve the issue. To contact them, please follow this link: Contact Us. When the message asks if you wish to receive an email, say NO then say speak to a representative and stay on the line.

Thank you for choosing TurboTax.

Related Content

pchan232tt

New Member

thorava

New Member

jakeplant_

New Member