Open TurboTax

Open TurboTax

Why sign in to the Community?

- Submit a question

- Check your notifications

- TurboTax Support

- :

- Discussions

- :

- Troubleshooting

- :

- Troubleshooting

- :

- Re: Error code #561

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

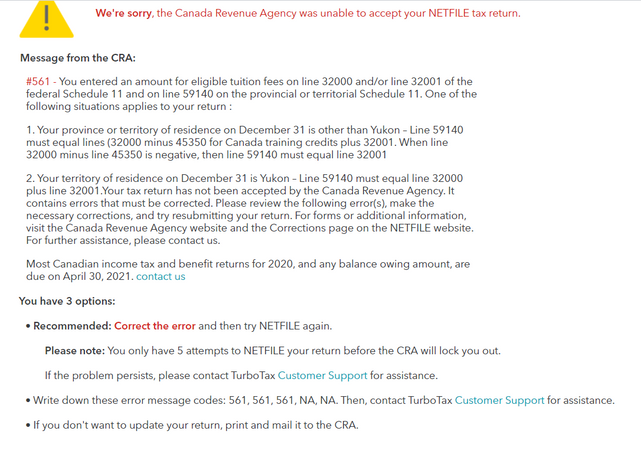

Error code #561

Hi Team,

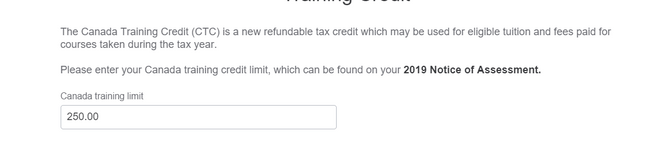

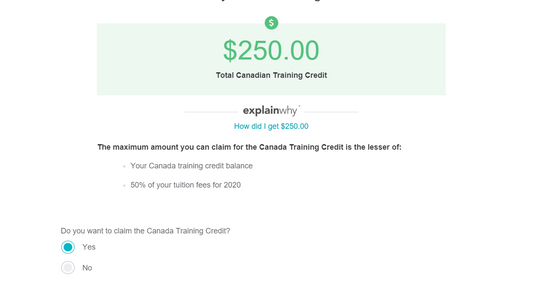

I added Canada Training tax credit of 250. The system is automictically calculated. Based on the explanation, your system is not added a correct number. Can you please help me fix this error?

After I entered T2202, This box was showed and I entered 250

After I entered it, the system is automatically calculated

I am looking forward to hearing from you

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Error code #561

Apparently, I discovered that if the Canada Training Credit Limit is not mentioned on your previous notice of assessment, you will get this error #561 and it will be rejected by CRA. Therefore, I tried again after checking my 2019 NOA and without claiming the $250 training credit and it went through successfully this time.

So, check your 2019 NOA if the training credit is there. If it's not there you will not be able to claim it and it will be rejected with error message 561.

Regards,

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Error code #561

I have this same error #561 message

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Error code #561

I have the same error. I have completed the equation shown in the error message. Line 32000 minus line 45350 is not negative on my return. Therefore I should not be getting the error.

Your province or territory of residence on December 31 is other than Yukon – Line 59140 must equal lines (32000 minus 45350 for Canada training credits plus 32001. When line 32000 minus line 45350 is negative, then line 59140 must equal line 32001

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Error code #561

Apparently, I discovered that if the Canada Training Credit Limit is not mentioned on your previous notice of assessment, you will get this error #561 and it will be rejected by CRA. Therefore, I tried again after checking my 2019 NOA and without claiming the $250 training credit and it went through successfully this time.

So, check your 2019 NOA if the training credit is there. If it's not there you will not be able to claim it and it will be rejected with error message 561.

Regards,

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Error code #561

Did not solve the problem. I still get error code 561

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Error code #561

If sagie4life's solution didn't help you, please contact our phone support team at 1-888-829-8608.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Error code #561

Hi, I'm having the same error message, really at my wits end. I don't have cell coverage where I live and therefore can't call, I tried calling over wifi and it's way too choppy. Is there a customer service email address we can correspond through? I've tried looking through the actual copy that is being sent to the CRA and cant figure out what is wrong or what I need to change.

thanks,

Carly

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Error code #561

@CarlyT If sagie4life's solution above didn't help you, you can message us on social media if you can't reach us by phone.

We are on Facebook at: https://www.facebook.com/messages/t/TurboTaxCanada

We are on Twitter at: https://twitter.com/messages/19496097-385034351

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Error code #561

I tried until I almost got kicked out, so what I did, was efile without any amount for tuition fees, then immediately went back and re-filed with the correct amounts, and it was fine... go figure.

Related Content

nickl59

New Member

visiontee

New Member

Rajsahdev

Returning Member

romeopan77

Returning Member

THEONECR7

New Member