Open TurboTax

Open TurboTax

Why sign in to the Community?

- Submit a question

- Check your notifications

- TurboTax Support

- :

- Discussions

- :

- Troubleshooting

- :

- Troubleshooting

- :

- Re: How I should enter my foreign interest income?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How I should enter my foreign interest income?

I am filling out the 'Statement of Investment Income' section and have a question regarding the 'Income from foreign sources in 2023.' I arrived in Canada and became a resident in August 2023. Throughout the year 2023, I earned bank interest income from my home country. However, I can't find any sections where I can input (1) the portion of foreign investment (interest) income earned when I was or was not a resident, and (2) the exchange rate to convert the currency. Could you please advise me on how I should enter my foreign interest income?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How I should enter my foreign interest income?

For TurboTax Desktop, please follow the steps below:

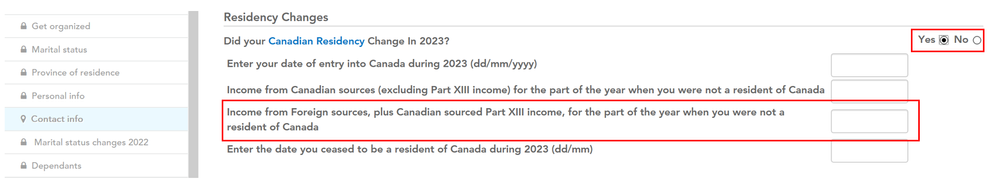

- For the portion of your income from foreign sources when you were not a resident of Canada, go to the contact info page and enter the amount under Residency Changes section.

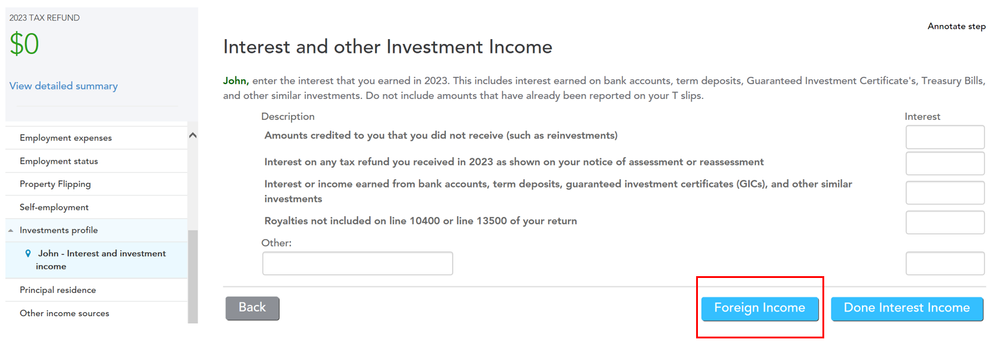

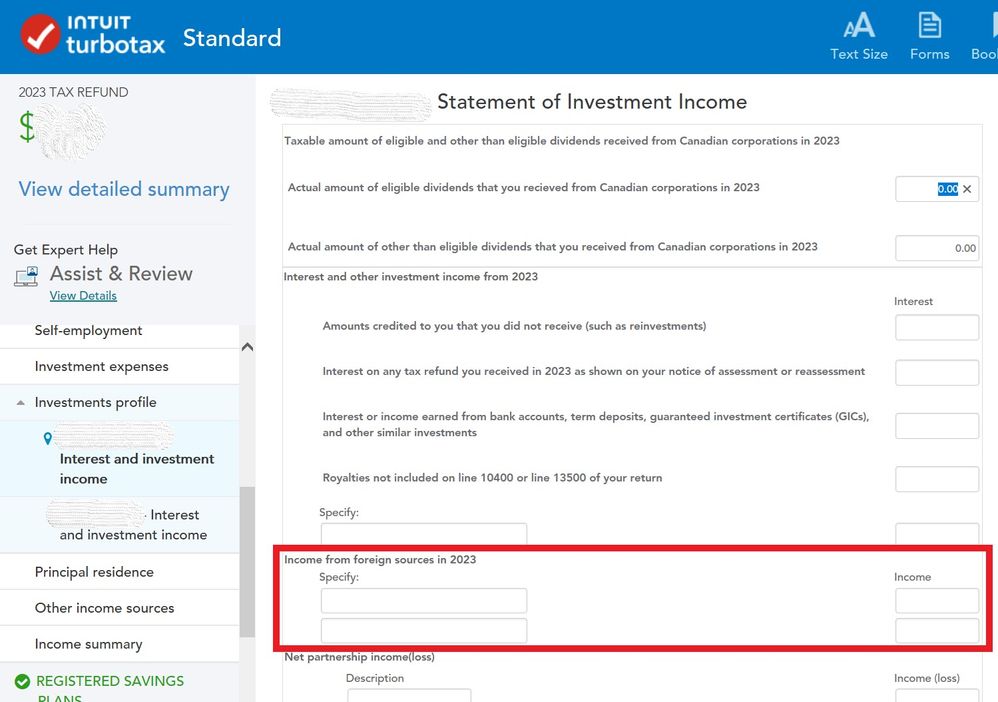

- For the portion of your income from foreign sources when you were a resident of Canada, go to Income & Expenses -> Investments Profile -> Select Interest and Investment Income and click Continue -> Click Foreign Income under Interest and other Investment Income page -> Enter the interest you earned from Froeign sources when you were a resident in the Income from Foreign Sources page

- Foreign income needs to be reported in Canadian dollars. Use the Bank of Canada exchange rate in effect on the day that you received the income. If you received the income at different times during the year, use the average annual rate. The average monthly rate and the daily rate are available by visiting the Bank of Canada.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How I should enter my foreign interest income?

Hi Jessica,

Thank you for showing me step by step. However, I can't find "Foreign Income under Interest and other Investment Income page" after selecting "Interest and Investment Income" and clicking "Continue".

Here is the layout I have in my version:

Should I input my foreign investment (interest) income earned after I became a resident of Canada in the section highlighted in RED?

Thank you!

Unlock tailored help options in your account.

Related Content

709eric

Returning Member

ontariotaxpayer

New Member

edwardjzheng

New Member

wesjp

Returning Member

sharont

Level 1