Open TurboTax

Open TurboTax

Why sign in to the Community?

- Submit a question

- Check your notifications

- TurboTax Support

- :

- Discussions

- :

- Troubleshooting

- :

- Troubleshooting

- :

- Re: where does autofilled T5008 data g0? -- do i have to enter the totals myself onto Schedule 3,...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

where does autofilled T5008 data g0? -- do i have to enter the totals myself onto Schedule 3, or what?

I am using TurboTax Standard Edition.

I used CRA autofill. Now my T5008 is auto-filled with data ... but that data (the totals) doesn't seem to go anywhere. It does not appear in my Schedule 3 or my T1 General. Do I have to manually enter the totals myself onto Schedule 3, or what?

I called the TurboTax/Intuit helpline about this and was finally connected to a person who clearly knew nothing about this whole subject area, and had screaming kids in the background which made it hard to hear anyway.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

where does autofilled T5008 data g0? -- do i have to enter the totals myself onto Schedule 3, or what?

Hello,

The T5008 is a statement of securities transactions, like the sale of a security. The areas that are relevant to a calculation are the ‘Proceeds on Sale’ and ‘Cost or Book Value’, the amount you provide the values for would be the ‘Outlays and Expenses’. Some issues of the slip do not include the ‘Cost or Book Value’ which is the Adjusted Cost Base. The Adjusted Cost Base for a security is your average cost of that security that include the costs to acquire the security, it is integral to determining the capital gain or loss on the sale of that security.

For clarity, you need to review each T5008 slip to ensure the values are accurate as filed by your institution, such as ensuring the ACB is reported and if not you would provide that value, as well enter the Outlays and Expenses, if any. When the T5008 slip is entered to report a security transaction there is no need to report the transaction in schedule 3, as this would be reporting the transaction twice. Should receive other statement of transactions instead of a T5008 you would enter these transactions individually or in aggregate if the number of transactions are excessive on the schedule 3 and schedule 3 supplement.

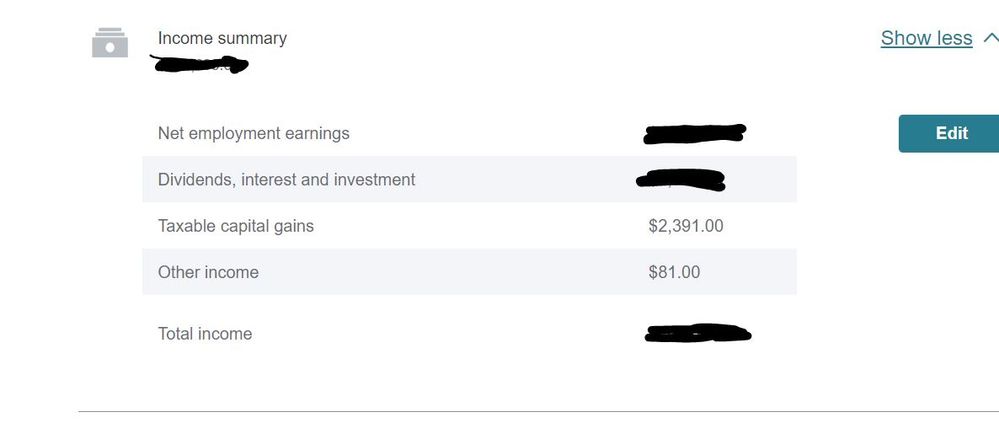

If the summation of the capital gains and losses, as reported on the schedule 3, result in an overall Capital Gain this amount would be reported on line 12700 of the T1 General. If the summation of the capital gains and losses, as reported on the schedule 3, result in an overall Capital Loss this amount would be carried forward, or could be carried back 3 years to reassess prior declarations of a capital gain by completing section II on form T1A, Request for Loss Carryback. Note, on your T1 General income tax and benefit return you will not see a current year Capital Loss reported, just in your schedule 3. Line 25300 only reports prior year capital losses carried forward that are being used in the current year to reduce a capital gain.

For your reference from TurboTax:

- How to Calculate a Capital Gain or Loss https://turbotax.intuit.ca/tips/how-to-calculate-a-capital-gain-or-loss-6345

- Carrying Capital Losses Backward or Forward https://turbotax.intuit.ca/tips/carrying-capital-losses-backward-or-forward-6249

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

where does autofilled T5008 data g0? -- do i have to enter the totals myself onto Schedule 3, or what?

I have the same issue and the response did not address the issue. If I add more T5008 slips or delete them or change the amount, it doesn't change my T1 or the taxable amount payable. It does not show up on schedule 3 anywhere? Is this a Turbotax bug? Thanks,

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

where does autofilled T5008 data g0? -- do i have to enter the totals myself onto Schedule 3, or what?

I found the answer ... when downloading the type of Income is not downloaded from the CRA site. Adding this field (mine are "Capital Gains") allows the program to work as expected.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

where does autofilled T5008 data g0? -- do i have to enter the totals myself onto Schedule 3, or what?

It would be an improvement if you could review each of the T5008 slips that TurboTax Online downloaded during autofill, the exchange rate used, and how the gains are calculated. Today, all I see in Schedule 3, Capital Gains (or Losses) form is the total on line 13199 and the Gain (or loss) calculated on line 13200. There is no indication anywhere in the Online version of the actual T5008s that were imported.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

where does autofilled T5008 data g0? -- do i have to enter the totals myself onto Schedule 3, or what?

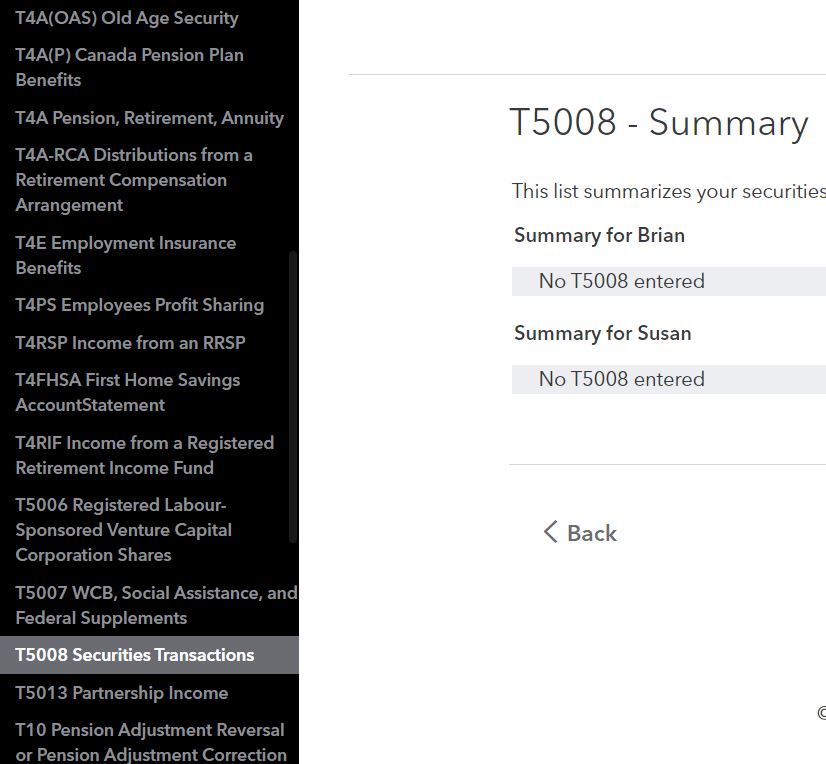

To review your T5008 information slip please go to the menu on the left and click on Income then T-slips then scroll down to the T5008 where you will be able to see or edit the information. You can also view the Detailed Tax Summary as seen in the image below. You can scroll up or down to see the T1 General return lines.

Thank you for choosing TurboTax.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

where does autofilled T5008 data g0? -- do i have to enter the totals myself onto Schedule 3, or what?

Just to be clear, I am using the online version. There does not appear to be any T5008 slip summary available. There does not appear to be a Detailed Tax Summary available either. Please note that I hit the "accept" for the SIN number entry a month ago : I think the detailed summary might have been available before that, but it is no longer there. The picture below indicates no T5008 info available, the second shows a very brief summary which is nothing like the screen shot you have shown.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

where does autofilled T5008 data g0? -- do i have to enter the totals myself onto Schedule 3, or what?

In order to help you with this situation, we believe your best option is to contact our telephone support team for further assistance, as they have the option to view your screen to help resolve the issue. To contact them, please follow this link: Contact Us. When asked if you wish to receive an email say NO then say "speak to a representative" then hold the line.

Thank you for choosing TurboTax.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

where does autofilled T5008 data g0? -- do i have to enter the totals myself onto Schedule 3, or what?

Capital Gains are reported on T5008s (stocks), T3s (trusts), T5013s (partnerships) and can be self entered on the Schedule 3 within TT0 under "Income > Investments > Capital Gains and Capital Gains Deduction Profile". For the slips, if you review them make certain they are entered as Capital Gains and not Investment Income, as there is a choice to be made. Best if you review your slips, or you can also acquire the value added service for Assist and Review to have a Tax Expert assist you in reviewing your Income Tax & Benefit Return. As TurboTaxGinette mentioned you can also reach out for assistance.

Related Content

kimmal

Returning Member

Erik63

New Member

dca

New Member

t4103gf

New Member

dianajw1

Level 3