- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo Tax is not deducting my RRSP spousal contributions

CRA says: Although you cannot contribute to your RRSP after December of the year you turn 71 years old, you can still contribute to your spouse's or common-law partner's RRSP until the December of the year that they turn 71. For more information, see RRSP options when you turn 71.

I have a deduction limit higher than the spousal contributions made, however TurboTax still shows "0" as my available contributions. How can I force TurboTax to show my contributions available?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo Tax is not deducting my RRSP spousal contributions

Have you made sure that the contribution was entered in the right box?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo Tax is not deducting my RRSP spousal contributions

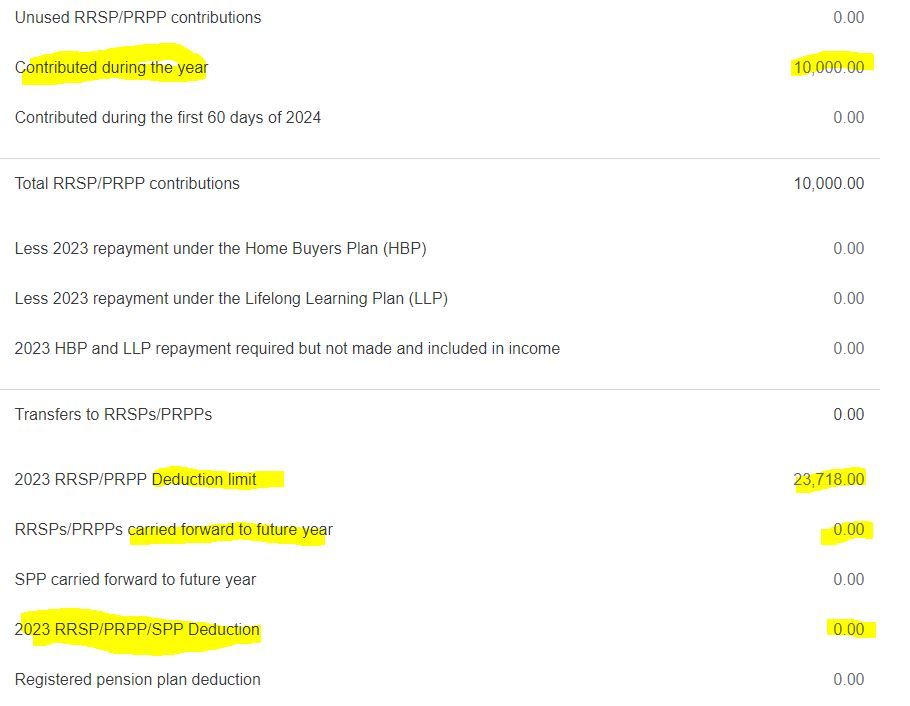

Hi, yes that is exactly the line I entered the amount into. The RRSP Summary shows the amount that I entered, but the line that shows the amount of the contribution shows 0 and the amount that shows as contributions available to be deducted shows 0.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo Tax is not deducting my RRSP spousal contributions

And the entry screen:

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo Tax is not deducting my RRSP spousal contributions

Please follow the steps seen in the images below to enter your spousal RRSP and receive the deductions.

Thank you for choosing TurboTax.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo Tax is not deducting my RRSP spousal contributions

Yes, this is how I entered the contribution, with the exception that we file our tax returns separately (our marriage status is "separated" but I was told because we are not divorced, she is officially my spouse and I can contribute to her RRSP) so I only have my own information. Will a marriage status of separated prevent the program from allowing the deduction?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo Tax is not deducting my RRSP spousal contributions

If your marital status is "Separated", then you don't have a spouse, and can't contribute to your former spouse's RRSP, unless you get back together again.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo Tax is not deducting my RRSP spousal contributions

I changed my marital status to Married, but it is still not allowing the spousal RRSP deduction. Any other ideas?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo Tax is not deducting my RRSP spousal contributions

It's ok; I just had to fill out the screen for my spouse's information, then it used the contribution as a deduction. Thank you for your help.