Open TurboTax

Open TurboTax

Why sign in to the Community?

- Submit a question

- Check your notifications

- TurboTax Support

- :

- Discussions

- :

- Troubleshooting

- :

- Troubleshooting

- :

- Income from Foreign Sources when I am not a resident of Canada

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Income from Foreign Sources when I am not a resident of Canada

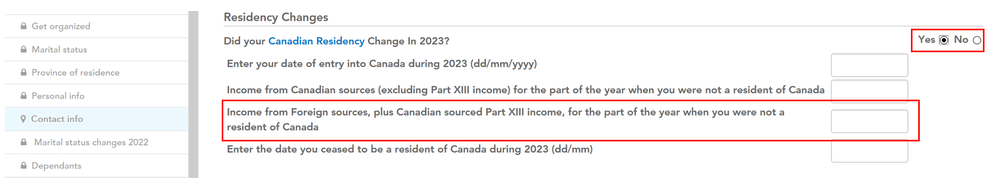

I am filling out the 'Residency Changes' section and have a question about the ‘Income from Foreign Sources for the part when you were not a resident of Canada, I'm unsure about what I need to fill in. I arrived in Canada and became a resident in August 2023. Should I include the employment income and investment income (bank interest) that I earned in my home country before August 2023 in this section?"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Income from Foreign Sources when I am not a resident of Canada

Yes, you should include all income that you earned in your home country before you became a resident of Canada under this section.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Income from Foreign Sources when I am not a resident of Canada

Hi Jessica,

Thank you for getting back promptly and noted that I should include all income that I earned in my home country before I became a resident of Canada under the section you mentioned.

Follow-up questions:

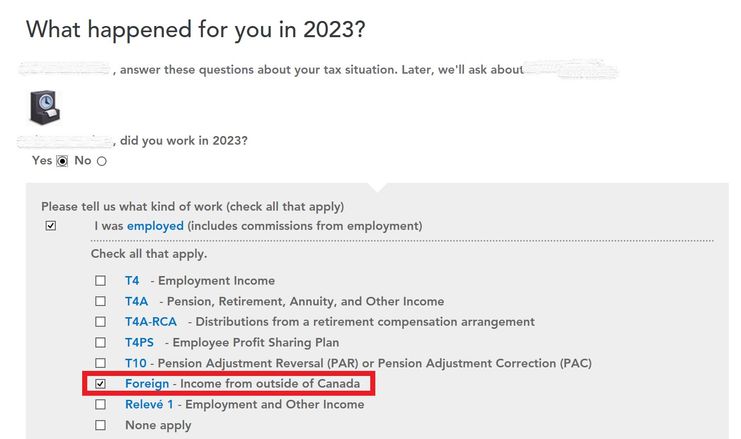

(1) Do I still need to input this amount again in the section "Foreign Income from outside of Canada" shown below? Or this section is just for the amount I earned after I became a resident of Canada?

(2) Please advise what should I include in the "Foreign Income from outside of Canada"? Employment Income? Investment Income? Or all income?

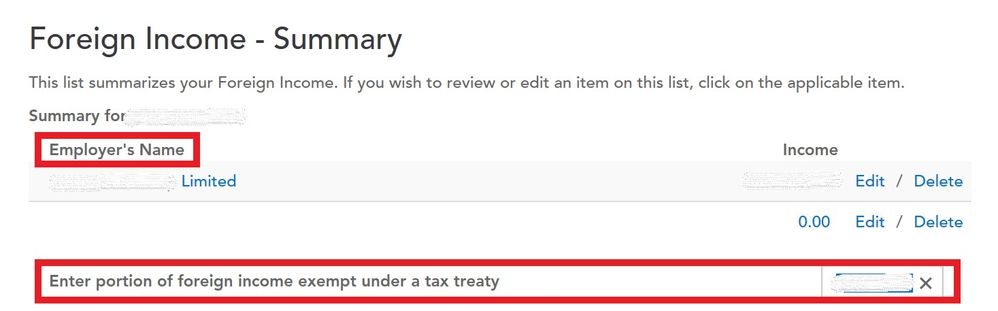

(3) For the below "Foreign Income -Summary", should I include "Employment Income" only? Amount should be for the whole year or just after I became a resident of Canada? What do I need to input for "Enter portion of foreign income exempt under a tax treaty"?

Thank you so much for your help.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Income from Foreign Sources when I am not a resident of Canada

Can Jessica or anyone from Turbotax help on this?

Thanks.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Income from Foreign Sources when I am not a resident of Canada

You would enter any amounts that you earned in a foreign country before you came to Canada in the 'Residency Changes' section. Income that you earned from a foreign country after you came to Canada can go on the foreign slip.

You don't need to enter anything under "Enter the portion of foreign income exempt under a tax treaty"? or "Tax treaty exempt amount" unless you have income that is exempt under a tax treaty. If you are not sure if you have anything like that, then you'll need to look at the tax treaty between Canada and your country, or talk to someone who is knowledgeable in such matters.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Income from Foreign Sources when I am not a resident of Canada

Hi, thanks for getting back to me. However, would you mind answering my questions (1) to (3) directly? I'm still confused about how to input the sections that I highlighted in red.

I really appreciate your assistance. Thank you!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Income from Foreign Sources when I am not a resident of Canada

In order to help you with this situation, we believe your best option is to contact our telephone support team for further assistance, as they have the option to view your screen to help resolve the issue. To contact them, please follow this link: Contact Us. When asked if you wish to receive an email say NO then say "speak to a representative" then hold the line.

Thank you for choosing TurboTax.

Related Content

Altenblpc

New Member

jennamcrrae64-gm

New Member

passernkl

Level 2

passernkl

Level 2

passernkl

Level 2