Open TurboTax

Open TurboTax

Why sign in to the Community?

- Submit a question

- Check your notifications

- TurboTax Support

- :

- Discussions

- :

- Troubleshooting

- :

- Troubleshooting

- :

- Re: ERROR "CPP/QPP contributions or pensionable earnings have been entered incorrectly. Check the amounts entered on your T4; particularly boxes 10, 14, 16, 17, 26, and 28. If the information entered ...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

ERROR "CPP/QPP contributions or pensionable earnings have been entered incorrectly. Check the amounts entered on your T4; particularly boxes 10, 14, 16, 17, 26, and 28. If the information entered matches your slips, please contact TurboTax support at htt

We understand your frustration. Unfortunately, the only way to avoid this is to either not prepare the returns together or to file only yours and start a new return for your spouse. We apologize for any inconvenience to you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

ERROR "CPP/QPP contributions or pensionable earnings have been entered incorrectly. Check the amounts entered on your T4; particularly boxes 10, 14, 16, 17, 26, and 28. If the information entered matches your slips, please contact TurboTax support at htt

This problem is with my sons return... it is not a joint return. He has had similar income prior years( T4 and self employment) and there has never been an issue like this. Very frustrating!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

ERROR "CPP/QPP contributions or pensionable earnings have been entered incorrectly. Check the amounts entered on your T4; particularly boxes 10, 14, 16, 17, 26, and 28. If the information entered matches your slips, please contact TurboTax support at htt

I am informing community members of my most recent experience regarding the "CPP Contributions/Pensionable Earnings Error." I finally received a phone call from Turbo Tax asking if

"I" had resolved my problem? Hello... I thought this was Turbo Tax's problem? Apparently the higher educated in problem solving have provided a "FIX" for this problem and NO it did not come in the way of an "Update" to the software. A month's worth of frustration and the resolve provided for MY PROBLEM is as follows....

IGNORE IT! So, not because I am following their advise (because I don't like ignoring a problem), but because I did my tax return manually (the old-fashioned way) and compared it to the Turbo Tax software return and they were Identical.... so I was comfortable to put an end to the frustration and IGNORE THE ERROR. Net result was that I was able to Continue with the Return.... and File it with Revenue Canada Electronically with SUCCESS! This was a couple of days ago. Today I received an email from Turbo Tax addressing the problem stating that I should file two returns instead of a combined return. I just laughed! With so much going on in our world today this small frustration is no longer a problem that I am wasting my time on. My advise.... just hit Ignore the Error and File Your Return. Good Luck!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

ERROR "CPP/QPP contributions or pensionable earnings have been entered incorrectly. Check the amounts entered on your T4; particularly boxes 10, 14, 16, 17, 26, and 28. If the information entered matches your slips, please contact TurboTax support at htt

Thank you for the advice. Unfortunately, I cannot ignore it because it doesn't allow me to NETFILE! I had to print the forms and sent them via regular mail, which is really frustrating as I also had to pay for post (and for Turbotax), when I have been filing through Netfile for years...

I find it really frustrating that Turbotax doesn't offer chat or email or a phone to report this as THEIR problem.

Hope they figure out after talking to you...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

ERROR "CPP/QPP contributions or pensionable earnings have been entered incorrectly. Check the amounts entered on your T4; particularly boxes 10, 14, 16, 17, 26, and 28. If the information entered matches your slips, please contact TurboTax support at htt

Sorry to hear that you were unsuccessful at Netfile. Luck of the draw I guess. No rationale to THEIR problem or THEIR inability to fix it.

glad you printed and mailed. Not worth the frustration so forget it... you are done now! Perhaps a request for credit on account as compensation is in order (on account for next year’s filing?) If enough people on their case.... might hastened them along? Then again, with all that is going on with self-isolation... maybe they are short staffed? Patience and allowances perhaps in order for this year?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

ERROR "CPP/QPP contributions or pensionable earnings have been entered incorrectly. Check the amounts entered on your T4; particularly boxes 10, 14, 16, 17, 26, and 28. If the information entered matches your slips, please contact TurboTax support at htt

Dear LyndaLee,

Please, very please, help me. How did you "Ignore" the error, and send the tax report through NETFILE??

Is there an option for you to click or to select to "Ignore" the error and send it in TurboTax? I certainly could NOT find any option for me to click or to select to "Ignore" the error and send it in TurboTax.

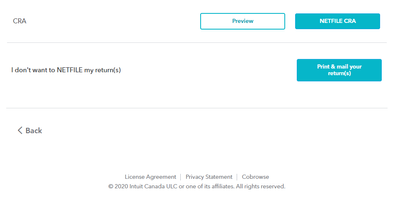

As soon as I click the "NETFILE CRA" button in TurboTax (see picture above), the error 90308 will pop up to indicate that my tax return has not been accepted by the Canada Revenue Agency. It contains errors that MUST be corrected.

May you very please write a step-by-step instruction on how to "Ignore" the error and send the tax report through NETFILE in TurboTax? Because I had lost my job recently due to the corona virus, I need the tax refund to pay my rent. So please help me.

Thank you a million time in advance for your invaluable help.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

ERROR "CPP/QPP contributions or pensionable earnings have been entered incorrectly. Check the amounts entered on your T4; particularly boxes 10, 14, 16, 17, 26, and 28. If the information entered matches your slips, please contact TurboTax support at htt

The problem is that the CPP overpayment calculation on Schedule 8 Part3 line 14 is not getting move to T1 General Form Line 4 4800.

Unfortunately there is no way to contact Turbo Tax to let them know there is a problem, so it will never get fixed.

Add if it does not get fixed you can not file using net file. Very Frustrating!!!

If any one know a way to contact a human at Turbo Tax to get this fixed that would be awesome.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

ERROR "CPP/QPP contributions or pensionable earnings have been entered incorrectly. Check the amounts entered on your T4; particularly boxes 10, 14, 16, 17, 26, and 28. If the information entered matches your slips, please contact TurboTax support at htt

To speak to a representative and in order to help you with this situation, we believe your best option is to contact our telephone support team for further assistance, as they have the option to view your screen to help resolve the issue. To contact them, please follow this link: Contact Us. When asked if you wish to receive an email say NO then say "speak to a representative" then hold the line. If a resolution is not reached, please ask for an escalation to investigate the problem.

Thank you for choosing TurboTax.

- « Previous

-

- 1

- 2

- Next »

Unlock tailored help options in your account.

Related Content

JulesBell

Returning Member

skwqAVNIbQ

New Member

JLR7208

Returning Member

Crewster

Returning Member

ahecki

New Member