Open TurboTax

Open TurboTax

Why sign in to the Community?

- Submit a question

- Check your notifications

- TurboTax Support

- :

- Discussions

- :

- Troubleshooting

- :

- Troubleshooting

- :

- Re: Ontario Childcare Access and Relief from Expenses (CARE) Credit

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Ontario Childcare Access and Relief from Expenses (CARE) Credit

Just select option 2 and select you or the spouse as the other supporting person and then enter your adjusted income from line 23600. Itll take that credit out and give you the correct amount once you enter that number in. The credit just assumes the supporting person as one person doesnt auto calculate multiple or assume it's two people like the online version does.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Ontario Childcare Access and Relief from Expenses (CARE) Credit

I have run into this as well. When I added spouse as a caregiver in the CARE section, my refund dropped dramatically. Guess I just want to know if you have to add spouse as well, or can just lower income person claim it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Ontario Childcare Access and Relief from Expenses (CARE) Credit

You'll want to start back at the Childcare Expenses Intro (sidebar > Deductions > Childcare Expenses).

1. After entering your Childcare Expenses, (and they are NOT being claimed by the higher income earner), continue

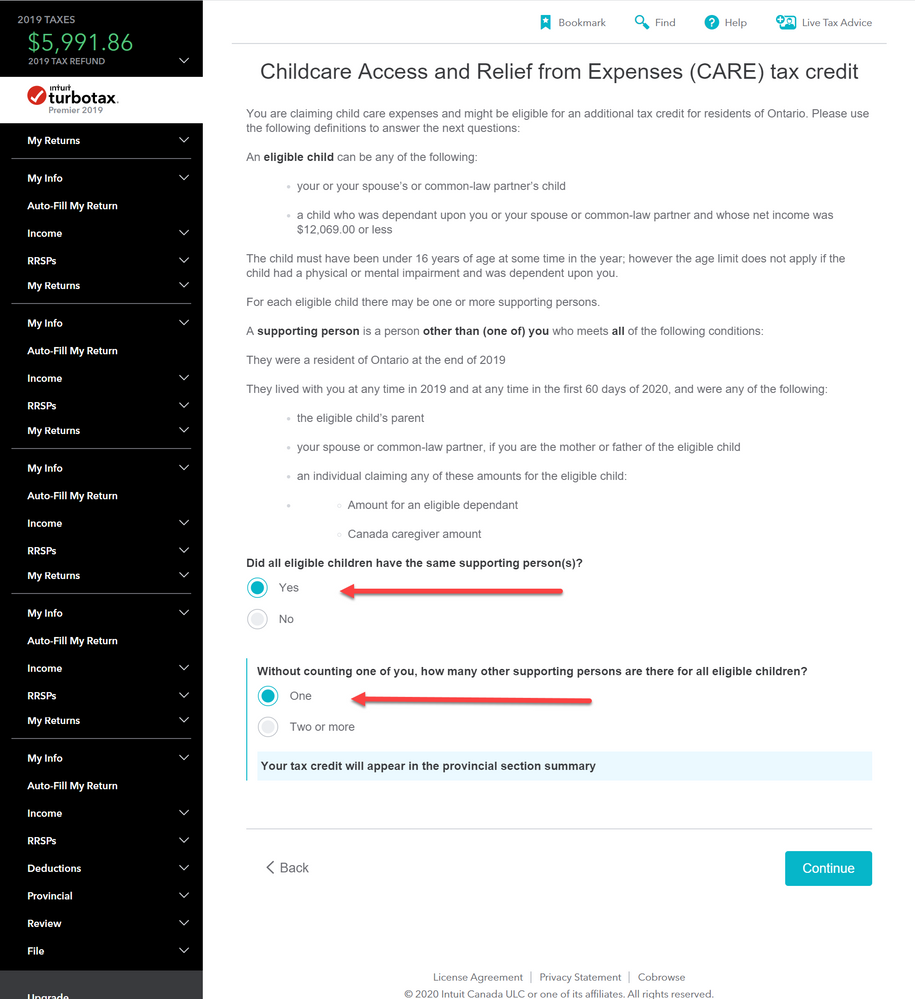

2. When you land on the "Childcare Access and Relief from Expenses (CARE) tax credit", you should have checked off YES to "Did all eligible children have the same supporting person(s)?" and ONE to "Without counting one of you, how many other supporting persons are there for all eligible children?".

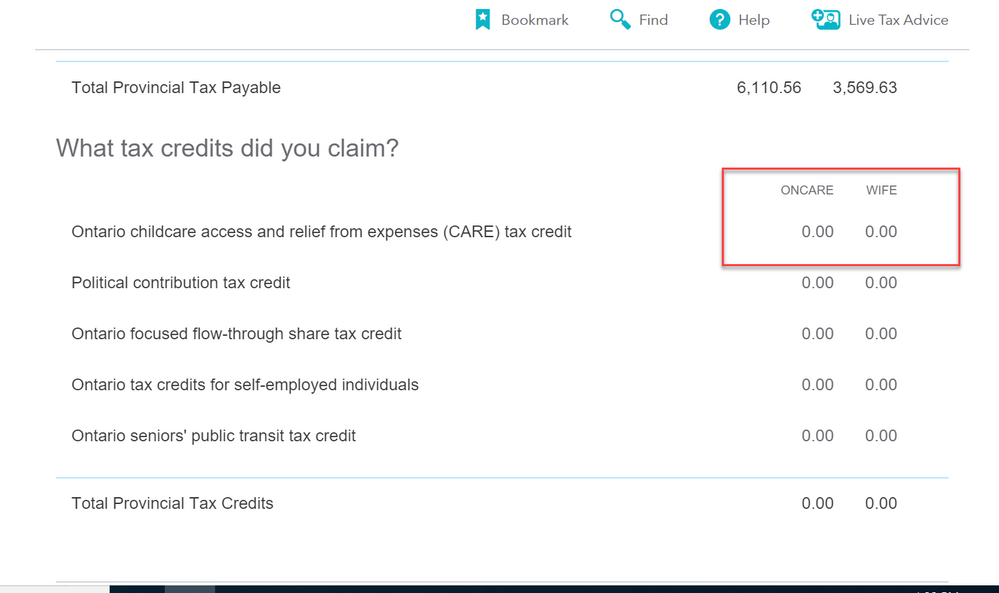

The first screenshot below shows "how to check the boxes", the second shows the Provincial Tax Summary with NO CREDITS for a couple who's income exceeds $150k.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Ontario Childcare Access and Relief from Expenses (CARE) Credit

Why are you answering this privately? We all have the same Question.

Why does applying for the "Childcare Access and Relief from Expenses (CARE) Tax Credit" reduce my return drastically?

seems like I would be better off not applying for it.

Your link to "Here is how to claim caregiver credit for your spouse" does not appear to address the above.

Please advise accordingly,

Thanks

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Ontario Childcare Access and Relief from Expenses (CARE) Credit

I was wondering the same thing, both private message, and the link that doesn't pertain to what my question is.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Ontario Childcare Access and Relief from Expenses (CARE) Credit

You'll want to start back at the Childcare Expenses Intro (sidebar > Deductions > Childcare Expenses).

1. After entering your Childcare Expenses, (and they are NOT being claimed by the higher income earner), continue

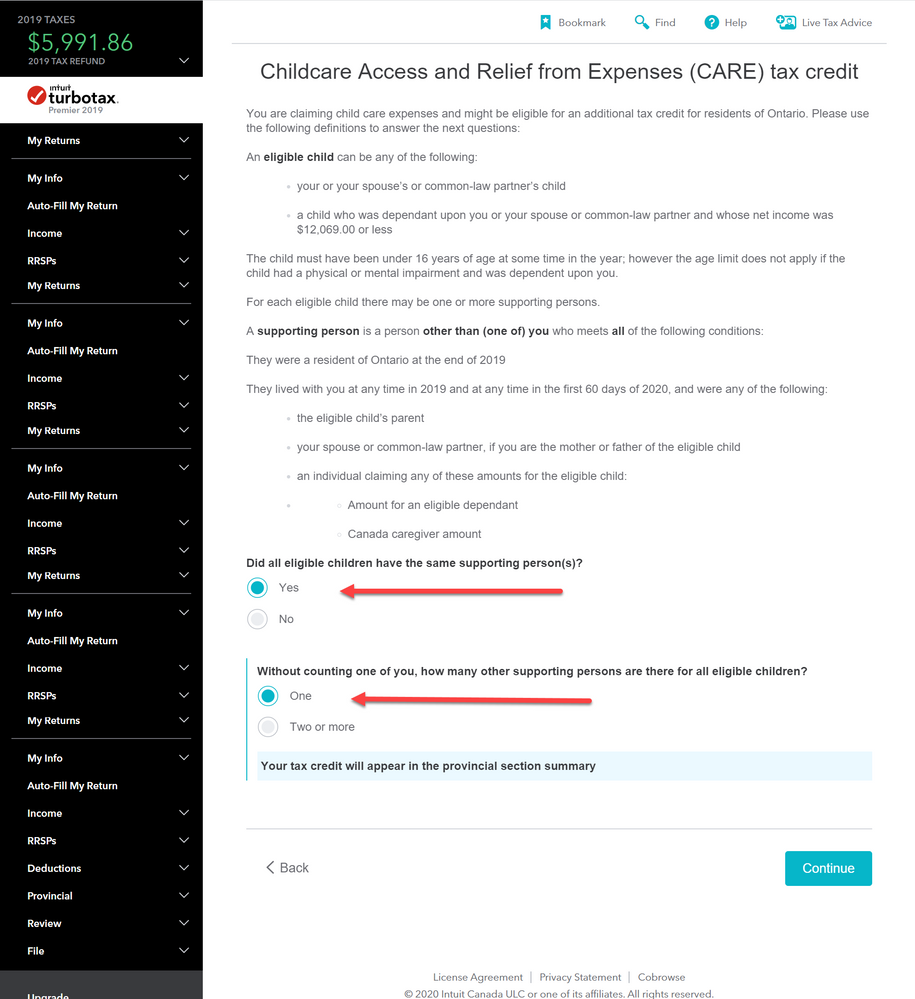

2. When you land on the "Childcare Access and Relief from Expenses (CARE) tax credit", you should have checked off YES to "Did all eligible children have the same supporting person(s)?" and ONE to "Without counting one of you, how many other supporting persons are there for all eligible children?".

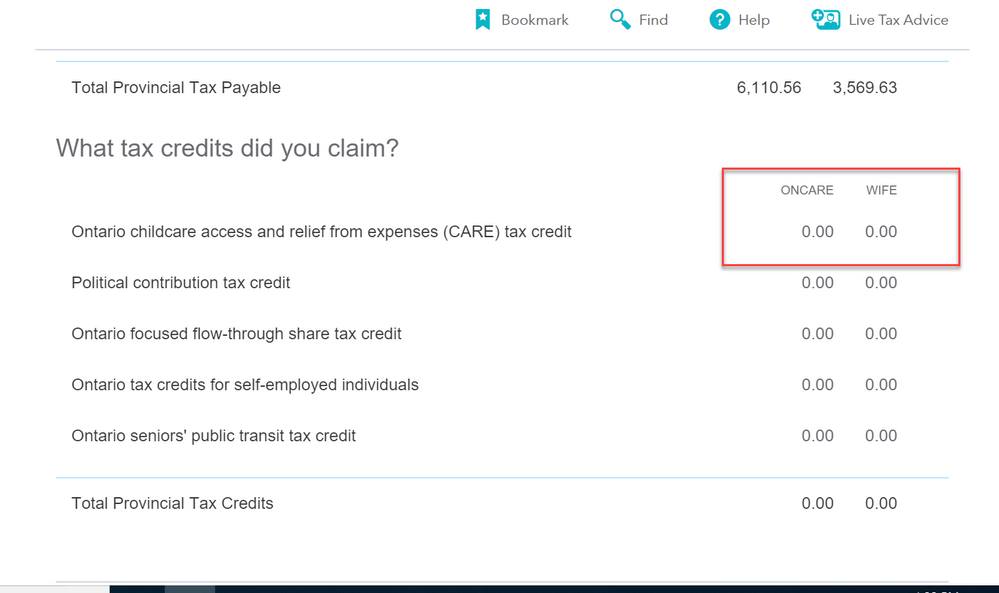

The first screenshot below shows "how to check the boxes", the second shows the Provincial Tax Summary with NO CREDITS for a couple who's income exceeds $150k

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Ontario Childcare Access and Relief from Expenses (CARE) Credit

Usually we get about 20% of the cost of daycare back as a tax refund. This time when I entered the $10K of expenses the refund went up by that same amount. Then, when completing the CARE page it dropped by $1.5K but still giving me about 85% back on child care expenses. This can't be right. Where's the Turbo Tax Administrators / Tech Support in all of this? The software is up to date as of April 10th, 2020.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Ontario Childcare Access and Relief from Expenses (CARE) Credit

The first amount can't be right. You don't get back exactly what you paid. And I can't judge the second amount because I don't know if you have paid these expenses for one child or more and the age of the children and what is your income. The software will calculate the correct amount when you finish the CARE page. The child care expenses is a deduction based on your tax rate federally and provincially. So it could be 20% more or less depending on the net income of each parent.

If you still have issues, please contact our support line: https://support.turbotax.intuit.ca/contact/

I hope this was helpful

- « Previous

-

- 1

- 2

- Next »

Related Content

Independent Tax Filer

Level 3

K_8

New Member

crut

New Member

newbee1

Level 2

Jlkc

New Member