Open TurboTax

Open TurboTax

Why sign in to the Community?

- Submit a question

- Check your notifications

- TurboTax Support

- :

- Discussions

- :

- Troubleshooting

- :

- Troubleshooting

- :

- Where do you enter Contractor Costs

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do you enter Contractor Costs

I am a self employed surveyor and I have to enter sub-contractor costs.

TurboTax indicates NOT to enter this in 'wages & salaries'. It says to enter it in the 'Cost of Goods Sold'. Well I can't get to this section to save my life!

in the Business Summary at the end of the Business/Professional Activities section, I see a tally for it. But there's no way to access it. I tried help, I tried Google.

The closest I can get is people talking about it being at the end of an 'Inventory' section.

Well I can't find access to this either!!!!

There' no preliminary summary section or profile for 'Professional Income' or I would assume that I missed selecting an 'inventory' section.

Are there not tens of thousands of people that DON'T sell goods - but provide professional services and require the help of sub-contractors?

HOW DO YOU ACCESS THIS?

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do you enter Contractor Costs

You need to delete all of the information in the T2125 for self employment - professional income, and answer the question as yes for "other" self-employment. This will bring up the section for retail, cost of goods, and inventory.

In my humble opinion, however, I would suggest adding it under Other expenses in the T2125 that you have. It isn't necessarily appropriate under cost of goods.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do you enter Contractor Costs

You need to delete all of the information in the T2125 for self employment - professional income, and answer the question as yes for "other" self-employment. This will bring up the section for retail, cost of goods, and inventory.

In my humble opinion, however, I would suggest adding it under Other expenses in the T2125 that you have. It isn't necessarily appropriate under cost of goods.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do you enter Contractor Costs

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do you enter Contractor Costs

Turbotax does not take me to the inventory section no matter what I do!

The only way to get there is to start a 'dummy' new business. I fill out all the prompts along the way the same as originally, and I do NOT see a prompt for 'Other' self employment. But yes, I get to the inventory page still.

But of course, it won't help me, because its in the wrong business profile (the dummy profile).

I tried saving a bookmark and then deleting the dummy business.

I go thru the real business and go to the bookmark. 'Yes,' I made it, but wonderfully, nothing I enter here affects the real business!

What on earth!?!

Delphision: you say to delete all of the information in the T2125 for self employment - pro..., What information are you referring to? The entire business profile? or just the administrative information? What do you mean.

I certainly don't want to try and re-enter all of the CCA information from past years.

This is absolutely insane! I have looked all over the internet and found tons of people asking the same thing, 'How do I get to the 'Inventory' section?' and all anyone from Intuit ever answers is 'just go into the business section and skip the income part and you'll find it.'

Really?!

No, you will only find it if you entered some specific field a certain way earlier. Otherwise, you're out of luck!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do you enter Contractor Costs

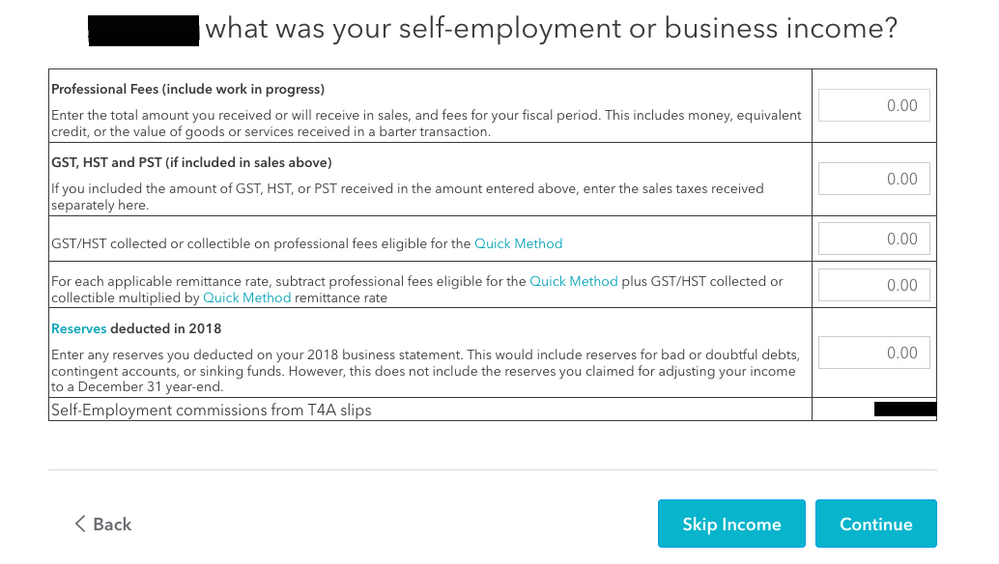

Do you mean I need to delete my entire self-employment profile? What exactly does delete all information mean? I can not find 'Inventory' anywhere and the cost of goods sold just shows up as 0. I am also trying to enter payments made to contractors. The attached picture is all I can see under 'Income and Inventory'

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do you enter Contractor Costs

Yeah - need help here from TT team

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do you enter Contractor Costs

Please see our TurboTax FAQs for guidance: The Beginner’s Guide to Self-Employed Taxes

Employed AND an Independent Contractor: What that means at tax time.

Thank you for choosing TurboTax.

Related Content

Donna5557676

New Member

dercole839

New Member

Anonymous

Not applicable

agmack

New Member

switchflaka

Level 3