Open TurboTax

Open TurboTax

Why sign in to the Community?

- Submit a question

- Check your notifications

- TurboTax Support

- :

- Discussions

- :

- Troubleshooting

- :

- Troubleshooting

- :

- Why is TT taking 60% of wife's RRSP withdrawal and applying it to the husband's return as income?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is TT taking 60% of wife's RRSP withdrawal and applying it to the husband's return as income?

Hello TT-

This is in regards to TT online.

I'm going to use sample #s to clarify what's going on.

- Dual income couple

- Wife's self-employment income of $100K

- Husband's income of $50K

- Wife made $30K withdrawal from her spousal RRSP

- When clicking on Review in the left hand pane I see the following:

- Wife's Tax Profile

- RRSP Income: $10K

- Self-employment Income: $100K

- Total income: $110K

- Husband's Tax Profile

- RRSP Income $20K

- Self-employment Income: 50K

- Total income: $70K

- Wife's Tax Profile

- I would expect to see the following:

- Wife's Tax Profile

- RRSP Income: $30K

- Self-employment Income: $100K

- Total income: $130K

- Husband's Tax Profile

- RRSP Income $0K

- Self-employment Income: 50K

- Total income: $50K

Why is TT shifting $20K from the wife to the husband. Does this have something to do with the fact that the money is coming from a Spousal RRSP to which the husband originally contributed? (We are in a situation where I over-contributed big time to my wife's Spousal so we're looking at some unbalanced withdrawals in the future unfortunately.)

Thanks in advance for any clarification regarding what's happening.

On a final note, is there a way of getting into a Forms view with TT online? My understanding has always been that's a feature only available to desktop users.

Thanks in advance for any clarification.

Patrick

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is TT taking 60% of wife's RRSP withdrawal and applying it to the husband's return as income?

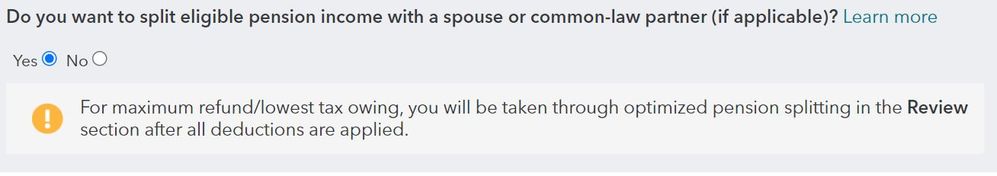

You are correct that there is no Forms View availability in our Online software. You can see the lines of the T1 General itself as seen in the image below. Did you click anywhere that you wished to split income in the interview?

Thank you for choosing TurboTax.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is TT taking 60% of wife's RRSP withdrawal and applying it to the husband's return as income?

Thanks for your response.

I'd forgotten that, for my wife, I did answer yes to the following question assuming that TurboTax would make the correct decision regarding splitting based on it's understanding of what's allowable.

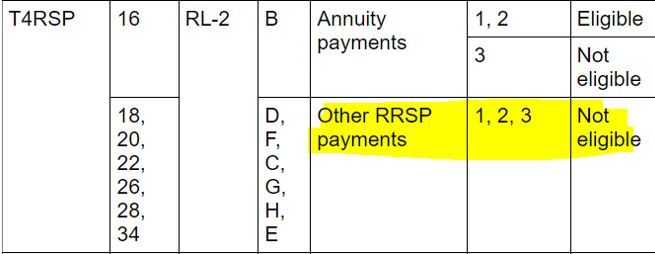

However, now looking at the CRA's rules below, I see that this RRSP income is not considered eligible. So I'm unclear on why, in the TurboTax income summary, I see 58% of the RRSP withdrawal applied to my income. From a tax perspective, this is what I want because I have a smaller income this year, but it seems like TurboTax is splitting the income regardless of whether I'm actually eligible to do so. (continued below).

What I'm hoping to hear is that TurboTax is legitimately moving some of the income over to my column because it was originally my income, I'm now 60 years old, and there's some reasonable CRA rule that says if it was originally my income and it's allowable to move some of that income back over to me in a year where my wife is actually earning more and it beneficial from a tax perspective.

What I assume, however is this:

1) If you specify that you want to split RRSP income, then TurboTax is going to do that whether you're actually eligible or not, and it's up to the taxpayer to know if that income is eligible or not.

2) I need to go back and answer "No" to the question above about whether I want to split the income.

If my assumptions are correct, I find it unfortunate that the CRA does not allow a husband and wife to rebalance contributions (i.e, no allowance for mistakes in balancing retirement). The problem I have is that I over contributed to my wife's spousal RRSP for several years, and the lion's share of our retirement is in her name. It's a self-induced wound from which the government will not allow us to recover from. We'll just stuck withdrawing in her name and paying a higher tax rate.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is TT taking 60% of wife's RRSP withdrawal and applying it to the husband's return as income?

Hello TurboTax -

I received an email today asking me if I'd received and answer to my question. Per the response I posted 2 days ago, I still have an outstanding question regarding how TurboTax is dealing with the Spousal RRSP income. I'll hold off explaining here since the question is clearly laid out above (or at least I hope so).

Thanks in advance for your clarification regarding how TT works in this context.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is TT taking 60% of wife's RRSP withdrawal and applying it to the husband's return as income?

Please reply to the email as you have purchased our Live advice service and they will be able to answer your questions while verifying your entries.

Thank you for choosing TurboTax.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is TT taking 60% of wife's RRSP withdrawal and applying it to the husband's return as income?

Hi TT-

To my knowledge, I've not purchased Live advice, and have no email indicating that I mistakenly made such a purchase. I have used Live advice in past years, but this year, I have only 2 product questions:

1) If you specify that you want to split RRSP income, is TurboTax is going to do the split whether you're actually eligible or not? Is it up to the taxpayer to know if that income is eligible or not?

2) Do I need to go back and answer "No" to the question above about whether I want to split the income?

Regards,

P.

Regards,

P.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is TT taking 60% of wife's RRSP withdrawal and applying it to the husband's return as income?

We cannot answer your question accurately without seeing all your entries in your RRSP section to see where the software is taking the amounts. You have mentioned over-contributions which creates a whole other scenario which needs to be dealt with immediately as you may be penalized by the Canada Revenue Agency (CRA). We do not give advice if you should or should not split your income. In order to help you with this situation, we believe your best option is to contact our telephone support team for further assistance, as they have the option to view your screen to help resolve the issue. To contact them, please follow this link: Contact Us. When you are asked if you wish to receive an email say NO then say "speak to a representative" and hold the line.

Thank you for choosing TurboTax.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is TT taking 60% of wife's RRSP withdrawal and applying it to the husband's return as income?

Hi TT-

My use of the phrase "over-contributed" was not referring to contributions in a given year. We're not in danger of being penalized by the CRA. What I'm saying is that I contributed for several years to my wife's spousal RRSP and now we have unbalanced account amounts. As an example assume the the following:

1) Husband individual RRSP has $100K

2) Wife's individual RRSP has $50K

3) Wife's spousal (containing husband's contributions) contains $1,000,000

Our actual figures differ but this illustrates what I mean by over-contributing to my wife's spousal account.

Given this, we're just left with a 2 related questions (repeated below) that are unrelated to the specifics of our returns. I'm asking how TurboTax functions at this point. Nothing more.

1) If you specify that you want to split RRSP income, is TurboTax is going to do the split whether you're actually eligible or not? Is it up to the taxpayer to know if that income is eligible or not?

2) Do I need to go back and answer "No" to the question above about whether I want to split the income?

You said above that you need to understand where TurboTax is taking the amount from. The answer is that I've entered entered amount for a single T4RSP (again a spousal for my wife) in the amount of $30K (to use the original example). And TT is moving $20K of the $30K to my income. Again, this is great, but the CRA guidance indicates this RRSP withdrawal is not eligible for splitting. I've provided the relevant screenshot highlighted in Yellow above, which says that if you're amount appears in box 22 then your withdrawal cannot be spilt - which begs the question why TT is splitting the income (i.e. the withdrawal amount appears in box 22 on our form).

Thanks in advance for your clarifications.

Regards,

P.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is TT taking 60% of wife's RRSP withdrawal and applying it to the husband's return as income?

Unfortunately, the software is allowing a split, using ineligible income. By working on this with our telephone support expert, they will be able to see that happen and correct the issue or have it investigated further. It should not be allowing this to happen. They will be able to test if you need to say NO or not. We cannot answer and give an answer without clarifying the possibilities due to overcontributions of the past as you mentioned earlier. With this situation, we believe your best option is to contact our telephone support team for further assistance, as they have the option to view your screen to help resolve the issue. To contact them, please follow this link: Contact Us. When you are asked if you wish to receive an email say NO then say "speak to a representative" and hold the line.

Thank you for choosing TurboTax.

Related Content

pisifamily

New Member

Batreid46

New Member

mccaffrey38

Returning Member

mccaffrey38

Returning Member

mccaffrey38

Returning Member